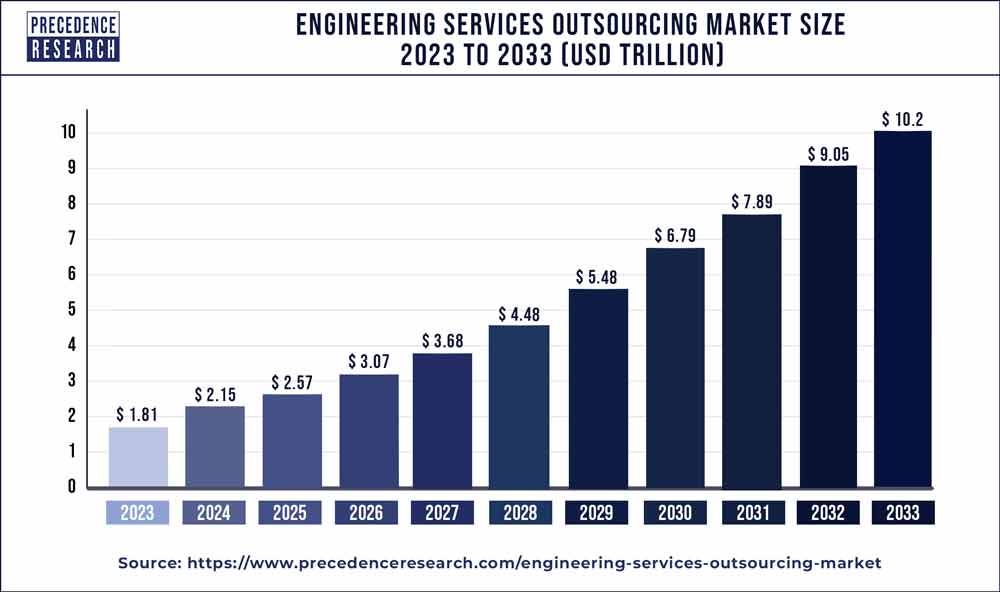

The global engineering services outsourcing market size is expected to reach around US$ 6.6 trillion by 2030 from US$ 1.5 trillion in 2021, growing at an impressive double-digit rate of 33.2% from 2022 to 2030.

The study includes drivers and restraints of this market. The study provides an analysis of the global engineering services outsourcing market for the period 2017-2030, wherein 2022 to 2030 is the forecast period and 2021 is considered as the base year.

One of the key drivers driving the adoption of the engineering services outsourcing is likely to be the growing collaborations between original equipment manufacturers and engineering service providers. The globalization of research and development activities, increased demand for utilizing the advanced and latest technologies into product offerings and the growing need to shorten product lifecycles and minimize costs are all likely to drive the engineering services outsourcing market expansion. The engineering services outsourcing market has been steadily developing in response to customer’s increasing emphasis on outsourcing various services as part of their cost-cutting efforts.

Our Free Sample Reports Includes:

- In-depth Industry Analysis, Introduction, Overview, and COVID-19 Pandemic Outbreak.

- Impact Analysis 150+ Pages Research Report (Including latest research).

- Provide chapter-wise guidance on request 2022 Updated Regional Analysis with Graphical Representation of Trends, Size, & Share, Includes Updated List of figures and tables.

- Updated Report Includes Major Market Players with their Sales Volume, Business Strategy and Revenue Analysis by using Precedence Research methodology.

Download Free Sample Copy Here (Including TOC, List of Tables & Figures, and Chart) @ https://www.precedenceresearch.com/sample/1750

The growing importance of engineering services providers in original equipment manufacturer supply chains is being boosted by evolving approaches to product lifecycle development. The engineering services providers are developing service delivery models that include far broader engagement portfolios and an authorization structure that promotes innovation and accelerates top line and bottom-line development as the engineering services outsourcing offering countries to expand.

Digitalization, on the other hand, brings with it concerns about cybersecurity. The engineering services providers, original equipment manufacturers and consumers communicate significant volumes of information with end user industries and industry verticals, including data related to monitoring, load management, and quality assurance. Similarly, engineering service providers and original equipment manufacturers frequently share secret information on technology and equipment in order to development and design of software and solutions. As a result, as part of their attempts to preserve intellectual property, the major market players are implementing preventative steps such as securing critical information with access codes, evaluating network operations, and maintaining original versions of the design of source code.

Report Scope of the Engineering Services Outsourcing Market

| Report Coverage | Details |

| Market Size by 2030 | USD 6.6 Trillion |

| CAGR from 2022 to 2030 | CAGR of 33.2% |

| Asia Pacifics Share in 2021 | 41% |

| Industrial Segment Share in 2021 | 61% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

Regional Snapshot

- North America is the largest segment for engineering services outsourcing market in terms of region. The North America region is home to long standing suppliers as well as end user sectors that are constantly adopting new and innovative technologies to improve business efficiency and productivity.

- Asia-Pacific region is the fastest growing region in the engineering services outsourcing market. For manufacturers and suppliers, the Asia-Pacific region has emerged as one of the most popular offshore outsourcing destinations.

Report Highlights

- Based on the service, the testing segment is the fastest growing segment in the global engineering services outsourcing market. The increased desire for testing services to be outsourced in order to reduce manual intervention and turn round time is predicted to contribute to the segment growth.

- Based on the application, the industrial segment is the fastest growing segment in the global engineering services outsourcing market. The industrial internet of things is predicted to drive the industrial segment’s expansion by reducing downtimes, detecting and preventing errors, and lowering maintenance costs.

Market Dynamics

Drivers

Growing research and development activities

The development of new and innovative technologies and solutions require research and development initiatives and good number of investments. The globalization of research and development has prompted leading industry participants to incorporate global delivery systems into their separate company strategies. Thus, the growing research and development activities are driving the growth of the engineering services outsourcing market during the forecast period.

Restraints

Risk of exposing confidential information

The major drawback of engineering services outsourcing is the danger of losing sensitive data and confidentiality. When negotiating outsourced deals, having flawless procedures and checks regarding data loss and confidentiality contracts is a necessity. Thus, the risk of exposing confidential information is hindering the growth of the engineering services outsourcing market over the forecast period.

Opportunities

Technological advancements

In order to provide innovative solutions to customers or end users, the engineering services outsourcing has evolved as well. As a result, the engineering services outsourcing market has seen a transition away from core engineering services and toward embedded engineering solutions such as internet of things. Similarly, technological advancements have opened the way for products as a service that are designed with integrated information technology solutions capable of scheduling maintenance and anticipating disruptions in advance. As a result, technological advancements is creating lucrative opportunities for the growth of the engineering services outsourcing market during the forecast period.

Challenges

High service costs

The small and medium enterprises do not have enough funds for the outsourcing of engineering services. The underdeveloped countries’ firms also lack resources for outsourcing business processes. Thus, the reason to this is high cost of services which each and every organization cannot afford to pay the engineering services outsourcing firms. As a result, the high service costs are a major challenge for the growth of the engineering services outsourcing market.

Research Methodology

A unique research methodology has been utilized to conduct comprehensive research on the growth of the global engineering services outsourcing market and arrive at conclusions on the future growth prospects of the market. This research methodology is a combination of primary and secondary research, which helps analysts warrant the accuracy and reliability of the draw conclusions. Secondary sources referred to by analysts during the production of the global market report include statistics from company annual reports, SEC filings, company websites, World Bank database, investor presentations, regulatory databases, government publications, and industry white papers. Analysts have also interviewed senior managers, product portfolio managers, CEOs, VPs, and market intelligence managers, who contributed to the production of our study on the market as a primary source.

These primary and secondary sources provided exclusive information during interviews, which serves as a validation from mattress topper industry leaders. Access to an extensive internal repository and external proprietary databases allows this report to address specific details and questions about the global engineering services outsourcing market with accuracy. The study also uses the top-down approach to assess the numbers for each segment and the bottom-up approach to counter-validate them. This has helped to estimates the future prospects of the global market more reliable and accurate.

Why should you invest in this report?

If you are aiming to enter the global engineering services outsourcing market, this report is a comprehensive guide that provides crystal clear insights into this niche market. All the major application areas for engineering services outsourcing are covered in this report and information is given on the important regions of the world where this market is likely to boom during the forecast period of 2022-2030, so that you can plan your strategies to enter this market accordingly.

Besides, through this report, you can have a complete grasp of the level of competition you will be facing in this hugely competitive market and if you are an established player in this market already, this report will help you gauge the strategies that your competitors have adopted to stay as market leaders in this market. For new entrants to this market, the voluminous data provided in this report is invaluable.

Some of the prominent players in the global engineering services outsourcing market include:

- Cybage Software Pvt. Ltd

- Sonata Software Limited

- Tata Consultancy Services Limited

- Tech Mahindra Limited

- Altair Engineering Inc.

- Wipro Limited

- HCL Technologies Limited

- QuEST Global Services Ltd

- EPAM Systems Inc.

- Accenture Plc.

Market Segmentation:

By Service

- Designing

- Prototyping

- System Integration

- Testing

- Others

By Location

- Onshore

- Offshore

By Application

- Aerospace

- Automotive

- Industrial

- Consumer Electronics

- Semiconductors

- Healthcare

- Telecom

- Others

Regional Analysis:

The geographical analysis of the global engineering services outsourcing market has been done for North America, Europe, Asia-Pacific, and the Rest of the World.

The North American Market is again segmented into the US, Canada, and Mexico. Coming to the European Market, it can be segmented further into the UK, Germany, France, Italy, Spain, and the rest. Coming to the Asia-Pacific, the global engineering services outsourcing Market is segmented into China, India, Japan, and Rest of Asia Pacific. Among others, the market is segmented into the Middle East and Africa, (GCC, North Africa, South Africa and Rest of the Middle East & Africa).

Key Questions Answered by the Report:

- What will be the size of the global engineering services outsourcing market in 2030?

- What is the expected CAGR for the engineering services outsourcing market between 2021 and 2030?

- Which are the top players active in this global market?

- What are the key drivers of this global market?

- How will the market situation change in the coming years?

- Which region held the highest market share in this global market?

- What are the common business tactics adopted by players?

- What is the growth outlook of the global engineering services outsourcing market?

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Engineering Services Outsourcing Market

5.1. COVID-19 Landscape: Engineering Services Outsourcing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Engineering Services Outsourcing Market, By Service

8.1. Engineering Services Outsourcing Market, by Service Type, 2022-2030

8.1.1. Designing

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Prototyping

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. System Integration

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Testing

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Engineering Services Outsourcing Market, By Application

9.1. Engineering Services Outsourcing Market, by Application, 2022-2030

9.1.1. Aerospace

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Automotive

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Industrial

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Consumer Electronics

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Semiconductors

9.1.5.1. Market Revenue and Forecast (2017-2030)

9.1.6. Healthcare

9.1.6.1. Market Revenue and Forecast (2017-2030)

9.1.7. Telecom

9.1.7.1. Market Revenue and Forecast (2017-2030)

9.1.8. Others

9.1.8.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Engineering Services Outsourcing Market, By Location

10.1. Engineering Services Outsourcing Market, by Location, 2022-2030

10.1.1. Onshore

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Offshore

10.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Engineering Services Outsourcing Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Service (2017-2030)

11.1.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.3. Market Revenue and Forecast, by Location (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Service (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.4.3. Market Revenue and Forecast, by Location (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Service (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.5.3. Market Revenue and Forecast, by Location (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Service (2017-2030)

11.2.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.3. Market Revenue and Forecast, by Location (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Service (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.4.3. Market Revenue and Forecast, by Location (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Service (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.5.3. Market Revenue and Forecast, by Location (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Service (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.6.3. Market Revenue and Forecast, by Location (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Service (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.7.3. Market Revenue and Forecast, by Location (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Service (2017-2030)

11.3.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.3. Market Revenue and Forecast, by Location (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Service (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.4.3. Market Revenue and Forecast, by Location (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Service (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.5.3. Market Revenue and Forecast, by Location (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Service (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.6.3. Market Revenue and Forecast, by Location (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Service (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.7.3. Market Revenue and Forecast, by Location (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Service (2017-2030)

11.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.3. Market Revenue and Forecast, by Location (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Service (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.4.3. Market Revenue and Forecast, by Location (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Service (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.5.3. Market Revenue and Forecast, by Location (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Service (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.6.3. Market Revenue and Forecast, by Location (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Service (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.7.3. Market Revenue and Forecast, by Location (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Service (2017-2030)

11.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.3. Market Revenue and Forecast, by Location (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Service (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.4.3. Market Revenue and Forecast, by Location (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Service (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.5.3. Market Revenue and Forecast, by Location (2017-2030)

Chapter 12. Company Profiles

12.1. Cybage Software Pvt. Ltd

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Sonata Software Limited

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Tata Consultancy Services Limited

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Tech Mahindra Limited

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Altair Engineering Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Wipro Limited

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. HCL Technologies Limited

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. QuEST Global Services Ltd

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. EPAM Systems Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Accenture Plc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

0 Comments