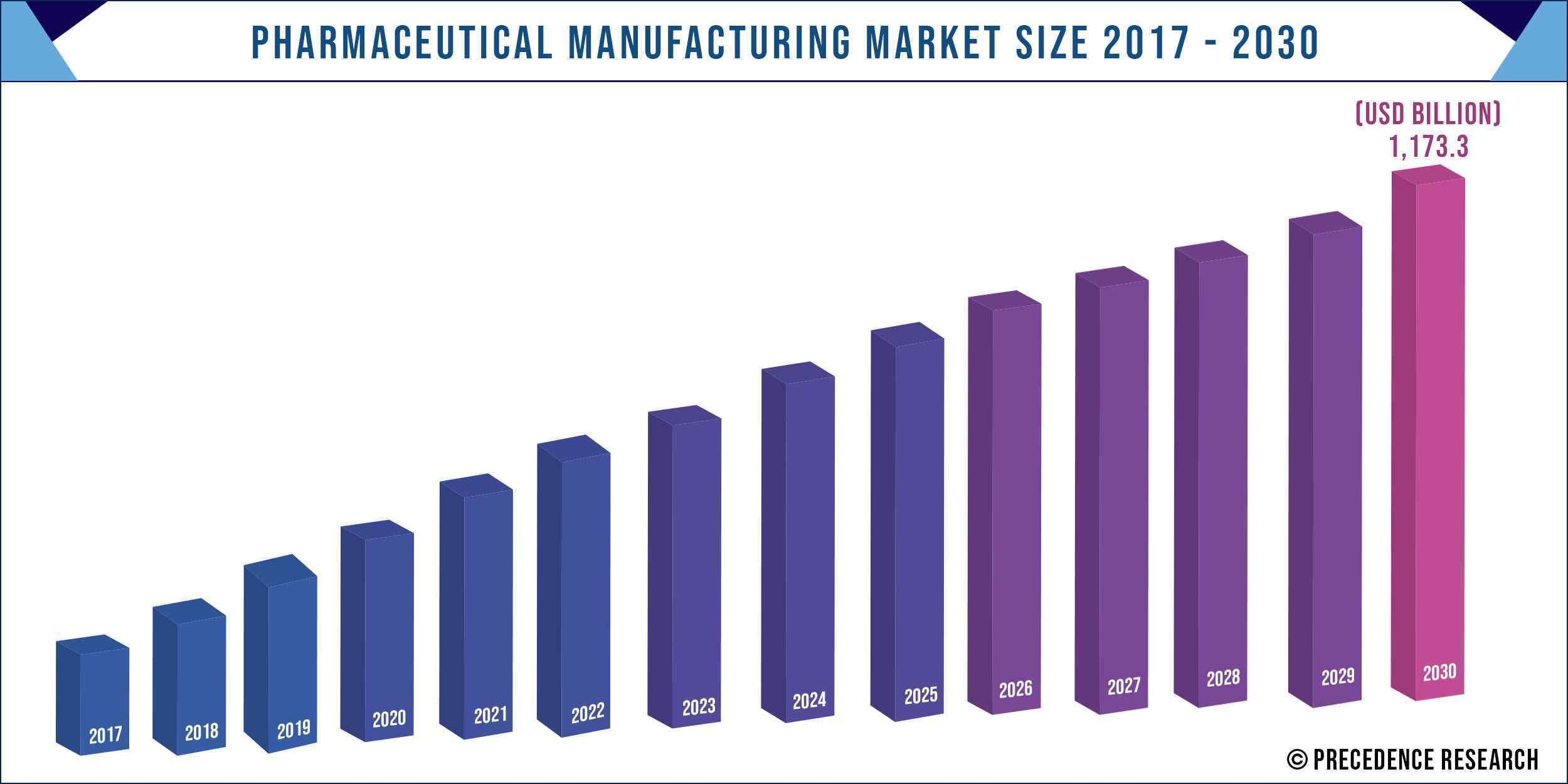

The global Pharmaceutical Manufacturing Market size reach around US$ 1,173.3 Bn by 2027 and is anticipated to grow at a CAGR of around 12.8% from 2020 to 2027.

|

Precedence Research, Recently Published Report on “Pharmaceutical Manufacturing Market Size, Share, Growth, Trends, Segment Forecasts, Regional Outlook 2020 - 2027”. The report offers an up-to-date analysis regarding the current market scenario, latest trends, key drivers, potential challenges, profitability graph and the overall market environment.

The pharmaceutical business is a vital segment of the larger healthcare ecosystem. The pharmaceutical industry primarily deals with scientific research activities and the development of medications that avert or treat ailments and disorders. The pharmaceutical industry comprises of both private as well as public establishments that conceive, promote, produce, and retail medicines. Modern technological and scientific breakthroughs are speeding up the detection and development of innovative medications or treatments with improved healing activity and less side effects. Medicinal chemists, molecular biologists, and pharmacists work collectively for enhancing the quality and efficiency of the drugs. Pharmaceutical manufacturing is the procedure of commercial-scale creation of medicines by pharmaceutical establishments.

Get the Sample Pages of Report for More Understanding@ https://www.precedenceresearch.com/sample/1191

The growing demand for modernization of pharmaceutical manufacturing process has prompted leading companies to employ new technologies such as continuous pharmaceutical manufacturing. This technology offers probable flexibility, superiority, and economic rewards over batch processing, together in process manufacturing and expansion for the pharmaceutical sector. Since the past few years, there have been significant advancements in science and engineering to support the implementation of continuous pharmaceutical manufacturing. These advancements, together with the acceptance of the QbD paradigm for pharmaceutical progress and the development of PAT for designing, examining, and controlling production, have advanced the scientific and monitoring eagerness for continuous manufacturing.

Growth Factors:

Factors such as increasing prevalence of chronic ailments, growing geriatric population, high investment in research and development, increasing focus on outsourcing manufacturing activities, increasing per capita healthcare expenditure, growing incidence of novel viral diseases, technological advancements in manufacturing processes, and improving reimbursement scenario in developing regions are driving the growth of pharmaceutical manufacturing market. Amplified focus on elderly and pediatric patients, high incidence of cardiovascular disorders, growing demand for home-based healthcare, and increased cancer and diabetes cases are further propelling the pharmaceutical manufacturing market expansion across the globe. Additional aspects that are anticipated to fuel this industry are increasing demand for new drug delivery approaches and reformulation of injections and oral medications.

The pharmaceutical industry is predominantly motivated by scientific advancements, in combination with clinical and toxicological experience. Major variances exist between large establishments and smaller organizations. Large pharmaceutical companies participate in an extensive range of medicine discovery and development, production and quality control, promotion and sales, whereas small pharmaceutical companies focus on a precise aspect.

Report Highlights:

- Among the drug development type segment, in-house drug development is expected to dominate the overall market. The use of in-house drug development capabilities by large pharmaceutical companies for securing the crucial information is a major reason for the high market share of in-house segment.

- The oral route of administration accounted for the largest revenue in the containers segment with more than 68% share in 2020. Affordability, ease of use and storage are the major reason for high market share of oral route of administration. Parenteral segment is expected to grow at the topmost CAGR during the forecast time-frame.

- Tablets accounted for the largest revenue in the formulation segment. Widespread availability of tablets is the key reason for high market share.

- Cancer accounted for the largest revenue in the therapy segment. High incidence of cancer globally and heavy investment in research and development for developing effective cancer therapies are the key reasons for high market share.

- F. Hoffmann-La Roche Ltd., Novartis AG, and Pfizer, Inc. accounted for a significant share of the global pharmaceutical manufacturing market.

Get Customization on this Research Report@ https://www.precedenceresearch.com/customization/1191

Regional Analysis:

The report covers data for North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. In 2019, North America dominated the global market with a market share of more than 41%. U.S. signified the highest portion in the North American region largely due to large investment in pharmaceutical research and development and presence of skilled researchers. Furthermore, early implementation of latest therapies also contributed to the high market share of the United States.

Europe was the next important market mainly due to encouraging reimbursement scenario and high investment in research and development. The presence of leading companies in the European region is also expected to boost the demand for pharmaceutical manufacturing in the projected time-span. Asia Pacific is estimated to advance at the maximum CAGR of around 15.8% in the forecast period due to high incidence of chronic ailments. Middle East, Africa and Latin American region will exhibit noticeable progress.

Key Market Players and Strategies:

The major companies operating in the worldwide pharmaceutical manufacturing are GlaxoSmithKline plc, Merck & Co., Inc., Eli Lilly and Company, Johnson & Johnson, F. Hoffmann-La Roche Ltd., Lonza, Pfizer, Inc., Sanofi SA, Novartis AG, and AstraZeneca among others.

High investment in the research and development along with acquisition, mergers, and collaborations are the key strategies undertaken by companies operating in the global Pharmaceutical Manufacturing market. Moreover, the world organizations are providing help to the developing regions for stream lining healthcare. In December 2020, the European Investment Bank commenced the first ever arrangement to strengthen local manufacturing of (APIs) Active Pharmaceutical Ingredients in the African region and expand pharmaceutical manufacturing.

Market Segmentation

By Drug Development Type

- In-house

- Outsource

By Route of Administration

- Topical

- Oral

- Inhalations

- Parenteral

- Others

By Formulation

- Injectable

- Tablets

- Suspensions

- Capsules

- Sprays

- Others

By Therapy

- Diabetes

- Cardiovascular Diseases

- Respiratory Diseases

- Cancer

- Pain

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions& Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Pharmaceutical Manufacturing Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

Chapter 5. COVID 19 Impact on Pharmaceutical Manufacturing Market

5.1. Covid-19: Pharmaceutical Manufacturing Industry Impact

5.2. Pharmaceutical Manufacturing Business Impact Assessment: Covid-19

5.2.1. Services Challenges/Disruption

5.2.2. Market Trends and Pharmaceutical Manufacturing Opportunities in the COVID-19 Landscape for Major Markets

5.3. Strategic Measures against Covid-19

5.3.1. Government Support and Initiative to Combat Covid-19

5.3.2. Proposal for Pharmaceutical Manufacturing Market Players to deal with Covid-19 Pandemic Scenario

Chapter 6. Pharmaceutical Manufacturing Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.1.1. Increasing prevalence of chronic ailments

6.1.1.2. Growing geriatric population

6.1.2. Market Restraints

6.1.2.1. Stringent Regulations

6.1.3. Market Opportunities

6.1.3.1. Increasing prevalence of chronic ailments

6.1.3.2. Growing geriatric population

Chapter 7. Global Pharmaceutical Manufacturing Market: Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.1.1. Pharmaceutical Manufacturing Market Revenue by Market Players (2016 -2019)

7.1.1.2. Pharmaceutical Manufacturing Market Revenue Market Share by Market Players (2016 -2019)

7.1.2. Key Organic/Inorganic Strategies Adopted by Players

7.1.2.1. Product Portfolio Expansion, Geographic Expansion, Drug Development Type Innovation

7.1.2.2. Merger and Acquisition, Collaboration and Partnerships

7.1.3. Market Players Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of End-users

Chapter 8. Global Pharmaceutical Manufacturing Market, By Drug Development Type

8.1. Pharmaceutical Manufacturing Market, by Drug Development Type, 2017-2030

8.1.1. In-house

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Outsource

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Pharmaceutical Manufacturing Market, By Route of Administration

9.1. Pharmaceutical Manufacturing Market, by Route of Administration, 2017-2030

9.1.1. Topical

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Oral

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Inhalations

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Parenteral

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Pharmaceutical Manufacturing Market, By Formulation

10.1. Pharmaceutical Manufacturing Market, by Formulation, 2017-2030

10.1.1. Injectable

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Tablets

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Suspensions

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Capsules

10.1.4.1. Market Revenue and Forecast (2017-2030)

10.1.5. Sprays

10.1.5.1. Market Revenue and Forecast (2017-2030)

10.1.6. Others

10.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Pharmaceutical Manufacturing Market, By Therapy

11.1. Pharmaceutical Manufacturing Market, by Therapy, 2017-2030

11.1.1. Diabetes

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Cardiovascular Diseases

11.1.2.1. Market Revenue and Forecast (2017-2030)

11.1.3. Respiratory Diseases

11.1.3.1. Market Revenue and Forecast (2017-2030)

11.1.4. Cancer

11.1.4.1. Market Revenue and Forecast (2017-2030)

11.1.5. Pain

11.1.5.1. Market Revenue and Forecast (2017-2030)

11.1.6. Others

11.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Pharmaceutical Manufacturing Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue Forecast by Drug Development Type(2017-2030)

12.1.2. Market Revenue Forecast by Route of Administration(2017-2030)

12.1.3. Market Revenue Forecast by Formulation (2017-2030)

12.1.4. Market Revenue Forecast by Therapy (2017-2030)

12.1.5. U.S

12.1.5.1. Market Revenue Forecast (2017-2030)

12.1.6. Canada

12.1.6.1. Market Revenue Forecast (2017-2030)

12.2. Europe

12.2.1. Market Revenue Forecast by Drug Development Type (2017-2030)

12.2.2. Market Revenue Forecast by Route of Administration (2017-2030)

12.2.3. Market Revenue Forecast by Formulation (2017-2030)

12.2.4. Market Revenue Forecast by Therapy (2017-2030)

12.2.5. UK

12.2.5.1. Market Revenue Forecast (2017-2030)

12.2.6. Germany

12.2.6.1. Market Revenue Forecast (2017-2030)

12.2.7. France

12.2.7.1. Market Revenue Forecast (2017-2030)

12.2.8. Rest of EU

12.2.8.1. Market Revenue Forecast (2017-2030)

12.3. Asia Pacific (APAC)

12.3.1. Market Revenue Forecast by Drug Development Type (2017-2030)

12.3.2. Market Revenue Forecast by Route of Administration (2017-2030)

12.3.3. Market Revenue Forecast by Formulation (2017-2030)

12.3.4. Market Revenue Forecast by Therapy (2017-2030)

12.3.5. China

12.3.5.1. Market Revenue Forecast (2017-2030)

12.3.6. India

12.3.6.1. Market Revenue Forecast (2017-2030)

12.3.7. Japan

12.3.7.1. Market Revenue Forecast (2017-2030)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue Forecast (2017-2030)

12.4. LATAM

12.4.1. Market Revenue Forecast by Drug Development Type (2017-2030)

12.4.2. Market Revenue Forecast by Route of Administration (2017-2030)

12.4.3. Market Revenue Forecast by Formulation (2017-2030)

12.4.4. Market Revenue Forecast by Therapy (2017-2030)

12.4.5. Brazil

12.4.5.1. Market Revenue Forecast (2017-2030)

12.4.6. Rest of LATAM

12.4.6.1. Market Revenue Forecast (2017-2030)

12.5. Middle East and Africa (MEA)

12.5.1. Market Revenue Forecast by Drug Development Type (2017-2030)

12.5.2. Market Revenue Forecast by Route of Administration (2017-2030)

12.5.3. Market Revenue Forecast by Formulation (2017-2030)

12.5.4. Market Revenue Forecast by Therapy (2017-2030)

12.5.5. GCC

12.5.5.1. Market Revenue Forecast (2017-2030)

12.5.6. North Africa

12.5.6.1. Market Revenue Forecast (2017-2030)

12.5.7. South Africa

12.5.7.1. Market Revenue Forecast (2017-2030)

12.5.8. Rest of MEA

12.5.8.1. Market Revenue Forecast (2017-2030)

Chapter 13. Company Profiles

13.1. GlaxoSmithKline plc

13.1.1. Company Overview, Business Information, Regional Presence

13.1.2. Product Portfolio Analysis

13.1.2.1. Product Details, Specification, Formulation

13.1.3. Revenue, Price, and Gross Margin (2015-2020)

13.1.4. Recent Developments and Strategies

13.2. Merck & Co., Inc.

13.2.1. Company Overview, Business Information, Regional Presence

13.2.2. Product Portfolio Analysis

13.2.2.1. Product Details, Specification, Formulation

13.2.3. Revenue, Price, and Gross Margin (2015-2020)

13.2.4. Recent Developments and Strategies

13.3. Eli Lilly and Company

13.3.1. Company Overview, Business Information, Regional Presence

13.3.2. Product Portfolio Analysis

13.3.2.1. Product Details, Specification, Formulation

13.3.3. Revenue, Price, and Gross Margin (2015-2020)

13.3.4. Recent Developments and Strategies

13.4. Johnson & Johnson

13.4.1. Company Overview, Business Information, Regional Presence

13.4.2. Product Portfolio Analysis

13.4.2.1. Product Details, Specification, Formulation

13.4.3. Revenue, Price, and Gross Margin (2015-2020)

13.4.4. Recent Developments and Strategies

13.5. F. Hoffmann-La Roche Ltd.

13.5.1. Company Overview, Business Information, Regional Presence

13.5.2. Product Portfolio Analysis

13.5.2.1. Product Details, Specification, Formulation

13.5.3. Revenue, Price, and Gross Margin (2015-2020)

13.5.4. Recent Developments and Strategies

13.6. Lonza

13.6.1. Company Overview, Business Information, Regional Presence

13.6.2. Product Portfolio Analysis

13.6.2.1. Product Details, Specification, Formulation

13.6.3. Revenue, Price, and Gross Margin (2015-2020)

13.6.4. Recent Developments and Strategies

13.7. Pfizer, Inc.

13.7.1. Company Overview, Business Information, Regional Presence

13.7.2. Product Portfolio Analysis

13.7.2.1. Product Details, Specification, Formulation

13.7.3. Revenue, Price, and Gross Margin (2015-2020)

13.7.4. Recent Developments and Strategies

13.8. Sanofi SA

13.8.1. Company Overview, Business Information, Regional Presence

13.8.2. Product Portfolio Analysis

13.8.2.1. Product Details, Specification, Formulation

13.8.3. Revenue, Price, and Gross Margin (2015-2020)

13.8.4. Recent Developments and Strategies

13.9. Novartis AG

13.9.1. Company Overview, Business Information, Regional Presence

13.9.2. Product Portfolio Analysis

13.9.2.1. Product Details, Specification, Formulation

13.9.3. Revenue, Price, and Gross Margin (2015-2020)

13.9.4. Recent Developments and Strategies

13.10. AstraZeneca

13.10.1. Company Overview, Business Information, Regional Presence

13.10.2. Product Portfolio Analysis

13.10.2.1. Product Details, Specification, Formulation

13.10.3. Revenue, Price, and Gross Margin (2015-2020)

13.10.4. Recent Developments and Strategies

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Buy this Premium Research Report@ https://www.precedenceresearch.com/checkout/1191

Contact Us:

Precedence Research

Apt 1408 1785 Riverside Drive Ottawa, ON, K1G 3T7, Canada

Call: +1 774 402 6168

Email: sales@precedenceresearch.com

0 Comments