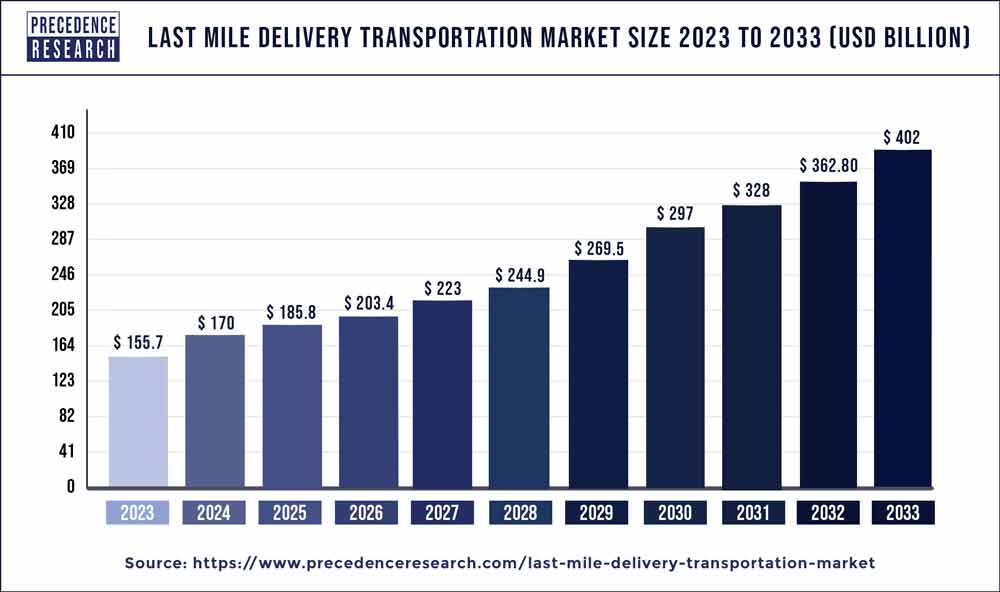

The global last mile delivery transportation market size is expected to reach around US$ 424.3 billion by 2030 from US$ 197.9 billion in 2022 and is expected to grow at an impressive double-digit rate of 10% from 2022 to 2030.

The study includes drivers and restraints of this market. The study provides an analysis of the global last mile delivery transportation market for the period 2017-2030, wherein 2022 to 2030 is the forecast period and 2021 is considered as the base year.

The last mile delivery primary service comprise of the deliver goods & services within the instructed time at affordable rate and in proper condition. The business of last mile delivery is meliorated and is anticipated to reach heights in coming times. Numerous shoppers and retailers are now growing on last mile logistics, which is likely make them to have a better market position. In addition, Amazon florescence has shifted into online distribution of retail where, the goods & services are delivered in the fixed time period with proper condition. In case of pastoral area, delivery points are at distance and rate of parcels is also low, then, the last mile delivery request is impacted.

Download Free Sample Copy Here (Including TOC, List of Tables & Figures, and Chart) @ https://www.precedenceresearch.com/sample/1578

Market Estimations Y-O-Y:

- Market Size Was Valued In 2021: US$ 179.96 Billion

- Market Size Is Projected to Grow By 2022: US$ 197.9 Billion

- Market Size Is Projected to Grow By 2023: US$ 217.64 Billion

- Market Size Is Projected to Grow By 2024: US$ 239.37 Billion

- Market Size Is Projected to Grow By 2025: US$ 263.28 Billion

- Market Size Is Projected to Grow By 2026: US$ 289.61 Billion

- Market Size Is Projected to Grow By 2027: US$ 318.69 Billion

- Market Size Is Projected to Grow By 2028: US$ 350.49 Billion

- Market Size Is Projected to Grow By 2029: US$ 385.62 Billion

- Market Size Is Projected to Grow By 2030: US$ 424.3 Billion

- Compound Annual Growth Rate (CAGR) from 2022 to 2030: 10 percent

Report Highlights

- On the basis of vehicle type, the segment named light duty vehicles had the majority of the last mile delivery transportation global market share in the year 2020. Furthermore, more cargo space, low cost, high speed & flexibility and other similar advantages are major factors are contributing to the high share which is held by the light duty vehicles segment.

- On the basis of cargo type, the segment named dry goods had the major share of the global market in the year 2020. Chemicals, liquor, oil, and other goods in liquid state have limitation on transportation and delivery in numerous countries.

Regional Snapshot

Asia Pacific garnered a market share of over 60% and dominated the global last mile delivery transportation market in 2020. The presence of around 60% of the global population in the region has presented lucrative growth opportunities for the market players. Moreover, the rising government investments in the infrastructural developments, urbanization, electrification, and development of IT and telecommunications infrastructure has prominently contributed towards the growth of the Asia Pacific last mile delivery transportation market. The rising disposable income, increased popularity of last mile delivery transportation among the youth, improved access to the internet, independent last mile delivery transportation, and rising penetration of the online delivery platforms like flipkart, amazon, and ubuy are some of the major factors that drives the market growth. Moreover, the increased adoption of the online payment platforms and the various promotional offers and discounts offered by the online payment apps like Phonepe, Pay tm, Amazon Pay, and Google Pay has significantly fostered the growth of the last mile delivery transportation market in this region. The rising employment levels and busy and hectic schedules of the consumers are driving the sale of the last mile delivery transportation owing to the conveniences associated with it. All these factors has made the Asia Pacific region, the fastest-growing last mile delivery transportation market too.

North America was the second-largest market in 2020. This is attributed to the increased adoption of the smartphones and the internet coupled with the increased demand for the convenient procut delivery services across North America. The busy and hectic life schedules along with the increased disposable income of the consumers have fostered the growth of the last mile delivery transportation market in this region.

Market Dynamics

Driver

There was significant instigation before the COVID-19 epidemic; still the key players were successful in providing required products to the door steps in the year 2020. The epidemic have provided an immense opportunities to the force chain on its head as further people began shopping online due to lockdown orders, quarantines, and many other concerns regarding health over in-person shopping. To gain a benefit in last- mile delivery, the key players requires understanding of the top trends in of the market and acclimatize to the ever changing geography and ameliorate the customer experience.

Restraint

Consumer’s rising demand towards greater quantities of services and products. Also, high frequency fulfilment and super-fast delivery services have come the custom, without assuming on numerous occasions the factual cost associated with the service handed. In certain sectors, the consumers themselves have propagated a free delivery culture that oppressively hampers sustainability and balance in a sector of activity undergoing a complete transformation. Paradoxically, however, it's this same consumer who, from the perspective of the citizen, is decreasingly concerned about the terrain and sustainability.

Opportunity

Automated systems and smart technology

The implementation of smart technology and automated systems, similar as IoT, has enabled companies to use real- time information in order to manage their line & make order changes during the last- minutes. In addition, the available data volume is likely rise exponentially, as telematics come commonplace and gain IoT operations. Furthermore, data analytics aids the key players to map out energy-effective routes in order to manage numerous stops. These advancements in technology are likely to provide significant openings for the last afar delivery transportation request during the forecast period.

Challenge

Last Mile logistical efficacy clearly represents a challenge for key players engaging in freight delivery and distribution in view of its significant, direct impact on operating margins, in which the Last Mile can represent up to 40% of the total parcel delivery cost. As a significance of the issues specific to each sector and the difficulties of last mile logistics, the average profitability of couriers has been significantly wind-swept while the volume managed has grown annually at double digit rates. Similarly, in the HORECA sector, benchmark distributors' profitability is double or triple times lower than that of the large global competitors and, in the retail food and general freight sector, a substantial portion of the retailers are finding if very difficult to generate revenue from their e-commerce channels.

Why should you invest in this report?

If you are aiming to enter the global last mile delivery transportation market, this report is a comprehensive guide that provides crystal clear insights into this niche market. All the major application areas for last mile delivery transportation are covered in this report and information is given on the important regions of the world where this market is likely to boom during the forecast period of 2022-2030, so that you can plan your strategies to enter this market accordingly.

Besides, through this report, you can have a complete grasp of the level of competition you will be facing in this hugely competitive market and if you are an established player in this market already, this report will help you gauge the strategies that your competitors have adopted to stay as market leaders in this market. For new entrants to this market, the voluminous data provided in this report is invaluable.

Some of the prominent players in the global last mile delivery transportation market include:

- Cargo Carriers Limited

- CEVA Logistics

- CJ Logistics Corporation

- Concargo Private Limited

- DB SCHENKER

- DHL Global Forwarding

- FedEx Corporation

- Interlogix Pty. Ltd.

- J&J Global Limited

- Kerry Logistics Network Limited

Market Segmentation:

By Vehicle Type

- Cargo Bike

- Two Wheeler Vehicle

- Drones

- Robots

- AGVs

- Vans

- Light Duty Vehicles

- Medium & Heavy Duty Vehicles

By Cargo Type

- Dry Goods

- Postal

- Liquid Goods

By End Use

- Food Delivery

- FMCG Products

- Health Products

- Postal

- Automotive Products

- Electronic Products

- Others

By Solution

- Real Time Tracking

- Automated Planning and Optimization

- Electronic Proof of Delivery

- Dynamic Re-routing

- Hardware Agnostic Platform

- Real Time ETA Calculation

- Interactive Planning Dashboard

- Delivery Route Planning Visualization

- Others

By Ownership

- In-house

- Third Party Logistics (3PL)

Regional Analysis:

The geographical analysis of the global last mile delivery transportation market has been done for North America, Europe, Asia-Pacific, and the Rest of the World.

The North American Market is again segmented into the US, Canada, and Mexico. Coming to the European Market, it can be segmented further into the UK, Germany, France, Italy, Spain, and the rest. Coming to the Asia-Pacific, the global last mile delivery transportation Market is segmented into China, India, Japan, and Rest of Asia Pacific. Among others, the market is segmented into the Middle East and Africa, (GCC, North Africa, South Africa and Rest of the Middle East & Africa).

Key Questions Answered by the Report:

- What will be the size of the global last mile delivery transportation market in 2030?

- What is the expected CAGR for the last mile delivery transportation market between 2021 and 2030?

- Which are the top players active in this global market?

- What are the key drivers of this global market?

- How will the market situation change in the coming years?

- Which region held the highest market share in this global market?

- What are the common business tactics adopted by players?

- What is the growth outlook of the global last mile delivery transportation market?

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Last Mile Delivery Transportation Market

5.1. COVID-19 Landscape: Last Mile Delivery Transportation Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Last Mile Delivery Transportation Market, By Vehicle Type

8.1. Last Mile Delivery Transportation Market, by Vehicle Type, 2022-2030

8.1.1. Cargo Bike

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Two Wheeler Vehicle

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Drones

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Robots

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. AGVs

8.1.5.1. Market Revenue and Forecast (2017-2030)

8.1.6. Vans

8.1.6.1. Market Revenue and Forecast (2017-2030)

8.1.7. Light Duty Vehicles

8.1.7.1. Market Revenue and Forecast (2017-2030)

8.1.8. Medium & Heavy Duty Vehicles

8.1.8.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Last Mile Delivery Transportation Market, By Cargo Type

9.1. Last Mile Delivery Transportation Market, by Cargo Type, 2022-2030

9.1.1. Dry Goods

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Postal

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Liquid Goods

9.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Last Mile Delivery Transportation Market, By End Use Type

10.1. Last Mile Delivery Transportation Market, by End Use Type, 2022-2030

10.1.1. Food Delivery

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. FMCG Products

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Health Products

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Postal

10.1.4.1. Market Revenue and Forecast (2017-2030)

10.1.5. Automotive Products

10.1.5.1. Market Revenue and Forecast (2017-2030)

10.1.6. Electronic Products

10.1.6.1. Market Revenue and Forecast (2017-2030)

10.1.7. Others

10.1.7.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Last Mile Delivery Transportation Market, By Solution Type

11.1. Last Mile Delivery Transportation Market, by Solution Type, 2022-2030

11.1.1. Real Time Tracking

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Automated Planning and Optimization

11.1.2.1. Market Revenue and Forecast (2017-2030)

11.1.3. Electronic Proof of Delivery

11.1.3.1. Market Revenue and Forecast (2017-2030)

11.1.4. Dynamic Re-routing

11.1.4.1. Market Revenue and Forecast (2017-2030)

11.1.5. Hardware Agnostic Platform

11.1.5.1. Market Revenue and Forecast (2017-2030)

11.1.6. Real Time ETA Calculation

11.1.6.1. Market Revenue and Forecast (2017-2030)

11.1.7. Interactive Planning Dashboard

11.1.7.1. Market Revenue and Forecast (2017-2030)

11.1.8. Delivery Route Planning Visualization

11.1.8.1. Market Revenue and Forecast (2017-2030)

11.1.9. Others

11.1.9.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Last Mile Delivery Transportation Market, By Ownership Type

12.1. Last Mile Delivery Transportation Market, by Ownership, 2022-2030

12.1.1. In-house

12.1.1.1. Market Revenue and Forecast (2017-2030)

12.1.2. Third Party Logistics (3PL)

12.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 13. Global Last Mile Delivery Transportation Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.1.2. Market Revenue and Forecast, by Cargo (2017-2030)

13.1.3. Market Revenue and Forecast, by End Use (2017-2030)

13.1.4. Market Revenue and Forecast, by Solution (2017-2030)

13.1.5. Market Revenue and Forecast, by Ownership (2017-2030)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.1.6.2. Market Revenue and Forecast, by Cargo (2017-2030)

13.1.6.3. Market Revenue and Forecast, by End Use (2017-2030)

13.1.6.4. Market Revenue and Forecast, by Solution (2017-2030)

13.1.7. Market Revenue and Forecast, by Ownership (2017-2030)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.1.8.2. Market Revenue and Forecast, by Cargo (2017-2030)

13.1.8.3. Market Revenue and Forecast, by End Use (2017-2030)

13.1.8.4. Market Revenue and Forecast, by Solution (2017-2030)

13.1.8.5. Market Revenue and Forecast, by Ownership (2017-2030)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.2.2. Market Revenue and Forecast, by Cargo (2017-2030)

13.2.3. Market Revenue and Forecast, by End Use (2017-2030)

13.2.4. Market Revenue and Forecast, by Solution (2017-2030)

13.2.5. Market Revenue and Forecast, by Ownership (2017-2030)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.2.6.2. Market Revenue and Forecast, by Cargo (2017-2030)

13.2.6.3. Market Revenue and Forecast, by End Use (2017-2030)

13.2.7. Market Revenue and Forecast, by Solution (2017-2030)

13.2.8. Market Revenue and Forecast, by Ownership (2017-2030)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.2.9.2. Market Revenue and Forecast, by Cargo (2017-2030)

13.2.9.3. Market Revenue and Forecast, by End Use (2017-2030)

13.2.10. Market Revenue and Forecast, by Solution (2017-2030)

13.2.11. Market Revenue and Forecast, by Ownership (2017-2030)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.2.12.2. Market Revenue and Forecast, by Cargo (2017-2030)

13.2.12.3. Market Revenue and Forecast, by End Use (2017-2030)

13.2.12.4. Market Revenue and Forecast, by Solution (2017-2030)

13.2.13. Market Revenue and Forecast, by Ownership (2017-2030)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.2.14.2. Market Revenue and Forecast, by Cargo (2017-2030)

13.2.14.3. Market Revenue and Forecast, by End Use (2017-2030)

13.2.14.4. Market Revenue and Forecast, by Solution (2017-2030)

13.2.15. Market Revenue and Forecast, by Ownership (2017-2030)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.3.2. Market Revenue and Forecast, by Cargo (2017-2030)

13.3.3. Market Revenue and Forecast, by End Use (2017-2030)

13.3.4. Market Revenue and Forecast, by Solution (2017-2030)

13.3.5. Market Revenue and Forecast, by Ownership (2017-2030)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.3.6.2. Market Revenue and Forecast, by Cargo (2017-2030)

13.3.6.3. Market Revenue and Forecast, by End Use (2017-2030)

13.3.6.4. Market Revenue and Forecast, by Solution (2017-2030)

13.3.7. Market Revenue and Forecast, by Ownership (2017-2030)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.3.8.2. Market Revenue and Forecast, by Cargo (2017-2030)

13.3.8.3. Market Revenue and Forecast, by End Use (2017-2030)

13.3.8.4. Market Revenue and Forecast, by Solution (2017-2030)

13.3.9. Market Revenue and Forecast, by Ownership (2017-2030)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.3.10.2. Market Revenue and Forecast, by Cargo (2017-2030)

13.3.10.3. Market Revenue and Forecast, by End Use (2017-2030)

13.3.10.4. Market Revenue and Forecast, by Solution (2017-2030)

13.3.10.5. Market Revenue and Forecast, by Ownership (2017-2030)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.3.11.2. Market Revenue and Forecast, by Cargo (2017-2030)

13.3.11.3. Market Revenue and Forecast, by End Use (2017-2030)

13.3.11.4. Market Revenue and Forecast, by Solution (2017-2030)

13.3.11.5. Market Revenue and Forecast, by Ownership (2017-2030)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.4.2. Market Revenue and Forecast, by Cargo (2017-2030)

13.4.3. Market Revenue and Forecast, by End Use (2017-2030)

13.4.4. Market Revenue and Forecast, by Solution (2017-2030)

13.4.5. Market Revenue and Forecast, by Ownership (2017-2030)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.4.6.2. Market Revenue and Forecast, by Cargo (2017-2030)

13.4.6.3. Market Revenue and Forecast, by End Use (2017-2030)

13.4.6.4. Market Revenue and Forecast, by Solution (2017-2030)

13.4.7. Market Revenue and Forecast, by Ownership (2017-2030)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.4.8.2. Market Revenue and Forecast, by Cargo (2017-2030)

13.4.8.3. Market Revenue and Forecast, by End Use (2017-2030)

13.4.8.4. Market Revenue and Forecast, by Solution (2017-2030)

13.4.9. Market Revenue and Forecast, by Ownership (2017-2030)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.4.10.2. Market Revenue and Forecast, by Cargo (2017-2030)

13.4.10.3. Market Revenue and Forecast, by End Use (2017-2030)

13.4.10.4. Market Revenue and Forecast, by Solution (2017-2030)

13.4.10.5. Market Revenue and Forecast, by Ownership (2017-2030)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.4.11.2. Market Revenue and Forecast, by Cargo (2017-2030)

13.4.11.3. Market Revenue and Forecast, by End Use (2017-2030)

13.4.11.4. Market Revenue and Forecast, by Solution (2017-2030)

13.4.11.5. Market Revenue and Forecast, by Ownership (2017-2030)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.5.2. Market Revenue and Forecast, by Cargo (2017-2030)

13.5.3. Market Revenue and Forecast, by End Use (2017-2030)

13.5.4. Market Revenue and Forecast, by Solution (2017-2030)

13.5.5. Market Revenue and Forecast, by Ownership (2017-2030)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.5.6.2. Market Revenue and Forecast, by Cargo (2017-2030)

13.5.6.3. Market Revenue and Forecast, by End Use (2017-2030)

13.5.6.4. Market Revenue and Forecast, by Solution (2017-2030)

13.5.7. Market Revenue and Forecast, by Ownership (2017-2030)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.5.8.2. Market Revenue and Forecast, by Cargo (2017-2030)

13.5.8.3. Market Revenue and Forecast, by End Use (2017-2030)

13.5.8.4. Market Revenue and Forecast, by Solution (2017-2030)

13.5.8.5. Market Revenue and Forecast, by Ownership (2017-2030)

Chapter 14. Company Profiles

14.1. Cargo Carriers Limited

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. CEVA Logistics

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. CJ Logistics Corporation

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Concargo Private Limited

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. DB SCHENKER

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. DHL Global Forwarding

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. FedEx Corporation

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Interlogix Pty. Ltd.

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. J&J Global Limited

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Kerry Logistics Network Limited

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Buy Full Research Report (Single User License US$ 4500) @ https://www.precedenceresearch.com/checkout/1578

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

0 Comments