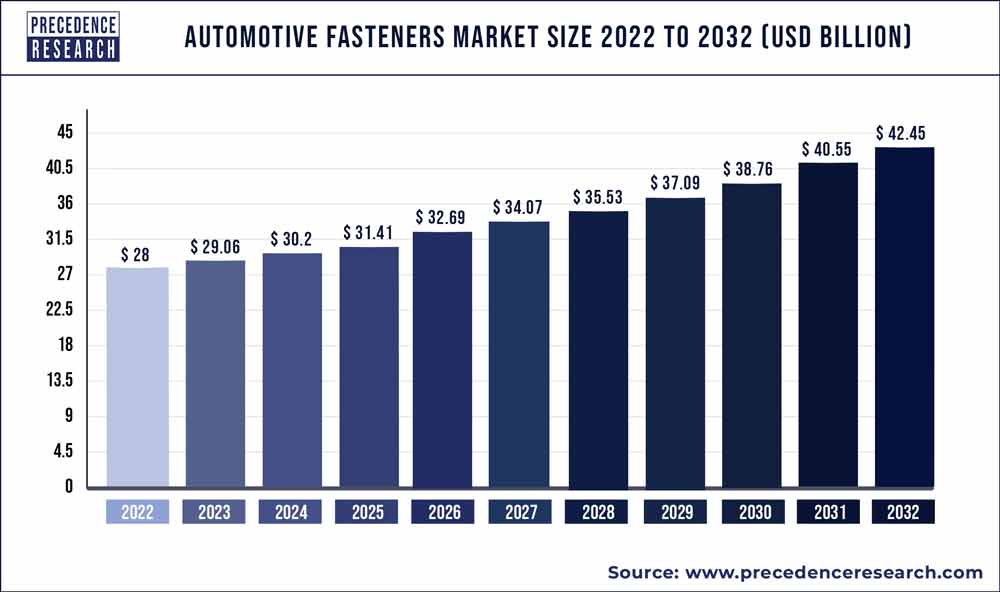

The global automotive fasteners market size is expected to reach around US$ 38.95 billion by 2030 from US$ 27.2 billion in 2021 and is expected to grow at an impressive double-digit rate of 4.1% from 2022 to 2030.

The study includes drivers and restraints of this market. The study provides an analysis of the global automotive fasteners market for the period 2017-2030, wherein 2022 to 2030 is the forecast period and 2021 is considered as the base year.

Our Free Sample Reports Includes:

- In-depth Industry Analysis, Introduction, Overview, and COVID-19 Pandemic Outbreak.

- Impact Analysis 180+ Pages Research Report (Including latest research).

- Provide chapter-wise guidance on request 2022 Updated Regional Analysis with Graphical Representation of Trends, Size, & Share, Includes Updated List of figures and tables.

- Updated Report Includes Major Market Players with their Sales Volume, Business Strategy and Revenue Analysis by using Precedence Research methodology.

Download Free Sample Copy Here (Including TOC, List of Tables & Figures, and Chart) @ https://www.precedenceresearch.com/sample/1611

Report Scope of the Automotive Fasteners Market

| Report Coverage | Details |

| Market Size by 2030 | USD 38.95 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 4.1% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

Report Highlights

- Based on the material, the stainless-steel segment is the fastest growing segment in the global automotive fasteners market. Due to their high tensile strength and rust resistance, stainless steel fasteners have a substantial market share in the automobile industry.

- Based on the product, the threaded segment is the fastest growing segment in the global automotive fasteners market. The threaded fasteners are used in a variety of applications including the assembly and disassembly of many sections and components of the automobiles.

- Based on the application, the wire harnessing segment is the fastest growing segment in the global automotive fasteners market. This is attributed to an increase in the use of fastening wire bundles which in turn is contributing to the global automotive fasteners market’s overall expansion.

Market Dynamics

Drivers

Rising penetration of battery powered trains

The fasteners are essential components for battery powered trains. The battery powered trains are being utilized on large scale due to the rising energy expense. The automotive fasteners help to enhance the efficiency of trains. The battery powered trains effectiveness is also increasing due to the implementation of automotive fasteners. Thus, the rising penetration of battery powered trains is boosting the growth of the global automotive fasteners market over the projected period.

Restraints

High capital investments

The automobiles have intricated mechanical and electrical systems. They have hundreds of moving parts, making development and maintenance difficult and expensive. For increased seasonal performance and operation, automotive fasteners ensure that the auto vehicle is in one state without any disbalances in distinct linked parts. The manufacturing of automobile fasteners is expensive and time-consuming, as well as risky, as many things might go wrong if the component is not built correctly. The vehicle fasteners have a substantially higher research and development expense than other automotive components. Thus, this factor is restricting the market growth.

Opportunities

Surge in sales of electric vehicles

The electric vehicle sector is quickly growing around the world. Electric vehicles, like any other transformational disruptive technology, trigger a flurry of new economic development, difficulties, and opportunities. Increased vehicle range, increased charging infrastructure availability, and proactive participation by automobile original equipment manufacturers are driving global electric car sales. Furthermore, as governments become more concerned about environmental issues, demand for zero-emission vehicles has surged, encouraging the expansion of the electric vehicle industry. Electric vehicles are being actively promoted in industrialized countries to minimize pollution, which has resulted in increased sales of electric vehicles. Thus, the surge in sales of electric vehicles is creating lucrative opportunities for the growth of the automotive fasteners market during the forecast period.

Challenges

Difficulty of refastening

The capacity to fasten and then refasten automotive fasteners is a benefit. This can be sometimes be a disadvantage, especially with automotive mechanical fasteners. Engines, for example, are densely packed with bolts that take a long time to remove and retorque. Other automotive fasteners such as ski boot buckles can speed up fastening and refastening. Thus, the difficulty of refastening is creating a major challenge for the growth of the automotive fasteners market.

Research Methodology

A unique research methodology has been utilized to conduct comprehensive research on the growth of the global automotive fasteners market and arrive at conclusions on the future growth prospects of the market. This research methodology is a combination of primary and secondary research, which helps analysts warrant the accuracy and reliability of the draw conclusions. Secondary sources referred to by analysts during the production of the global market report include statistics from company annual reports, SEC filings, company websites, World Bank database, investor presentations, regulatory databases, government publications, and industry white papers. Analysts have also interviewed senior managers, product portfolio managers, CEOs, VPs, and market intelligence managers, who contributed to the production of our study on the market as a primary source.

These primary and secondary sources provided exclusive information during interviews, which serves as a validation from mattress topper industry leaders. Access to an extensive internal repository and external proprietary databases allows this report to address specific details and questions about the global automotive fasteners market with accuracy. The study also uses the top-down approach to assess the numbers for each segment and the bottom-up approach to counter-validate them. This has helped to estimates the future prospects of the global market more reliable and accurate.

Why should you invest in this report?

If you are aiming to enter the global automotive fasteners market, this report is a comprehensive guide that provides crystal clear insights into this niche market. All the major application areas for automotive fasteners are covered in this report and information is given on the important regions of the world where this market is likely to boom during the forecast period of 2022-2030, so that you can plan your strategies to enter this market accordingly.

Besides, through this report, you can have a complete grasp of the level of competition you will be facing in this hugely competitive market and if you are an established player in this market already, this report will help you gauge the strategies that your competitors have adopted to stay as market leaders in this market. For new entrants to this market, the voluminous data provided in this report is invaluable.

Some of the prominent players in the global automotive fasteners market include:

- Bulten AB

- KAMAX

- Sundram Fasteners

- Stanley Black & Decker

- Shanghai Prime Machinery Company

- SFS Group

- Lisi Group

- The Philips Screw Company

- KOVA Fasteners Private Limited

- Westfield Fasteners Limited

Market Segmentation:

By Product

- Threaded

- Nuts Screws

- Rivets

- Studs

- Non-threaded

- Snap rings

- Clip

By Application

- Engine

- Chassis

- Transmission

- Steering

- Front/rear Axle

- Interior Trim

- Wire Harnessing

- Others

By Characteristics

- Removable Fasteners

- Permanent Fasteners

- Semi-permanent Fasteners

By Material

- Stainless Steel

- Bronze

- Iron

- Nickel

- Aluminum

- Brass

- Plastic

By Electric Vehicle Type

- Battery Electric Vehicle (BEV)

- Hybrid Electric Vehicle (HEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

By Vehicle Type

- Passenger Car

- Hatchback

- Sedan

- Luxury

- Light Commercial Vehicle

- Heavy Commercial Vehicle

By Distribution

- Automotive OEM

- Aftermarket

Regional Analysis:

The geographical analysis of the global automotive fasteners market has been done for North America, Europe, Asia-Pacific, and the Rest of the World.

The North American Market is again segmented into the US, Canada, and Mexico. Coming to the European Market, it can be segmented further into the UK, Germany, France, Italy, Spain, and the rest. Coming to the Asia-Pacific, the global automotive fasteners Market is segmented into China, India, Japan, and Rest of Asia Pacific. Among others, the market is segmented into the Middle East and Africa, (GCC, North Africa, South Africa and Rest of the Middle East & Africa).

Key Questions Answered by the Report:

- What will be the size of the global automotive fasteners market in 2030?

- What is the expected CAGR for the automotive fasteners market between 2021 and 2030?

- Which are the top players active in this global market?

- What are the key drivers of this global market?

- How will the market situation change in the coming years?

- Which region held the highest market share in this global market?

- What are the common business tactics adopted by players?

- What is the growth outlook of the global automotive fasteners market?

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. Market Dynamics Analysis and Trends

5.1. Market Dynamics

5.1.1. Market Drivers

5.1.2. Market Restraints

5.1.3. Market Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining power of suppliers

5.2.2. Bargaining power of buyers

5.2.3. Threat of substitute

5.2.4. Threat of new entrants

5.2.5. Degree of competition

Chapter 6. Competitive Landscape

6.1.1. Company Market Share/Positioning Analysis

6.1.2. Key Strategies Adopted by Players

6.1.3. Vendor Landscape

6.1.3.1. List of Suppliers

6.1.3.2. List of Buyers

Chapter 7. Global Automotive Fasteners Market, By Product

7.1. Automotive Fasteners Market, by Product, 2022-2030

7.1.1. Threaded

7.1.1.1. Market Revenue and Forecast (2017-2030)

7.1.2. Non-threaded

7.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 8. Global Automotive Fasteners Market, By Application

8.1. Automotive Fasteners Market, by Application, 2022-2030

8.1.1. Engine

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Chassis

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Transmission

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Steering

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Front/rear Axle

8.1.5.1. Market Revenue and Forecast (2017-2030)

8.1.6. Interior Trim

8.1.6.1. Market Revenue and Forecast (2017-2030)

8.1.7. Wire Harnessing

8.1.7.1. Market Revenue and Forecast (2017-2030)

8.1.8. Others

8.1.8.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Automotive Fasteners Market, By Characteristics

9.1. Automotive Fasteners Market, by Characteristics, 2022-2030

9.1.1. Removable Fasteners

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Permanent Fasteners

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Semi-permanent Fasteners

9.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Automotive Fasteners Market, By Material

10.1. Automotive Fasteners Market, by Material, 2022-2030

10.1.1. Stainless Steel

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Bronze

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Iron

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Nickel

10.1.4.1. Market Revenue and Forecast (2017-2030)

10.1.5. Aluminum

10.1.5.1. Market Revenue and Forecast (2017-2030)

10.1.6. Brass

10.1.6.1. Market Revenue and Forecast (2017-2030)

10.1.7. Plastic

10.1.7.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Automotive Fasteners Market, By Electric Vehicle

11.1. Automotive Fasteners Market, by Electric Vehicle, 2022-2030

11.1.1. Battery Electric Vehicle (BEV)

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Hybrid Electric Vehicle (HEV)

11.1.2.1. Market Revenue and Forecast (2017-2030)

11.1.3. Plug-in Hybrid Electric Vehicle (PHEV)

11.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Automotive Fasteners Market, By Vehicle

12.1. Automotive Fasteners Market, by Vehicle, 2022-2030

12.1.1. Passenger Car

12.1.1.1. Market Revenue and Forecast (2017-2030)

12.1.2. Light Commercial Vehicle

12.1.2.1. Market Revenue and Forecast (2017-2030)

12.1.3. Heavy Commercial Vehicle

12.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 13. Global Automotive Fasteners Market, By Distribution

13.1. Automotive Fasteners Market, by Distribution, 2022-2030

13.1.1. Automotive OEM

13.1.1.1. Market Revenue and Forecast (2017-2030)

13.1.2. Aftermarket

13.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 14. Global Automotive Fasteners Market, Regional Estimates and Trend Forecast

14.1. North America

14.1.1. Market Revenue and Forecast, by Product (2017-2030)

14.1.2. Market Revenue and Forecast, by Application (2017-2030)

14.1.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.1.4. Market Revenue and Forecast, by Material (2017-2030)

14.1.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.1.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.1.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.1.8. U.S.

14.1.8.1. Market Revenue and Forecast, by Product (2017-2030)

14.1.8.2. Market Revenue and Forecast, by Application (2017-2030)

14.1.8.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.1.8.4. Market Revenue and Forecast, by Material (2017-2030)

14.1.8.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.1.8.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.1.8.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.1.9. Rest of North America

14.1.9.1. Market Revenue and Forecast, by Product (2017-2030)

14.1.9.2. Market Revenue and Forecast, by Application (2017-2030)

14.1.9.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.1.9.4. Market Revenue and Forecast, by Material (2017-2030)

14.1.9.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.1.9.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.1.9.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.2. Europe

14.2.1. Market Revenue and Forecast, by Product (2017-2030)

14.2.2. Market Revenue and Forecast, by Application (2017-2030)

14.2.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.2.4. Market Revenue and Forecast, by Material (2017-2030)

14.2.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.2.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.2.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.2.8. UK

14.2.8.1. Market Revenue and Forecast, by Product (2017-2030)

14.2.8.2. Market Revenue and Forecast, by Application (2017-2030)

14.2.8.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.2.8.4. Market Revenue and Forecast, by Material (2017-2030)

14.2.8.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.2.8.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.2.8.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.2.9. Germany

14.2.9.1. Market Revenue and Forecast, by Product (2017-2030)

14.2.9.2. Market Revenue and Forecast, by Application (2017-2030)

14.2.9.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.2.9.4. Market Revenue and Forecast, by Material (2017-2030)

14.2.9.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.2.9.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.2.9.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.2.10. France

14.2.10.1. Market Revenue and Forecast, by Product (2017-2030)

14.2.10.2. Market Revenue and Forecast, by Application (2017-2030)

14.2.10.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.2.10.4. Market Revenue and Forecast, by Material (2017-2030)

14.2.10.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.2.10.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.2.10.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.2.11. Rest of Europe

14.2.11.1. Market Revenue and Forecast, by Product (2017-2030)

14.2.11.2. Market Revenue and Forecast, by Application (2017-2030)

14.2.11.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.2.11.4. Market Revenue and Forecast, by Material (2017-2030)

14.2.11.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.2.11.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.2.11.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.3. APAC

14.3.1. Market Revenue and Forecast, by Product (2017-2030)

14.3.2. Market Revenue and Forecast, by Application (2017-2030)

14.3.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.3.4. Market Revenue and Forecast, by Material (2017-2030)

14.3.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.3.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.3.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.3.8. India

14.3.8.1. Market Revenue and Forecast, by Product (2017-2030)

14.3.8.2. Market Revenue and Forecast, by Application (2017-2030)

14.3.8.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.3.8.4. Market Revenue and Forecast, by Material (2017-2030)

14.3.8.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.3.8.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.3.8.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.3.9. China

14.3.9.1. Market Revenue and Forecast, by Product (2017-2030)

14.3.9.2. Market Revenue and Forecast, by Application (2017-2030)

14.3.9.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.3.9.4. Market Revenue and Forecast, by Material (2017-2030)

14.3.9.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.3.9.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.3.9.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.3.10. Japan

14.3.10.1. Market Revenue and Forecast, by Product (2017-2030)

14.3.10.2. Market Revenue and Forecast, by Application (2017-2030)

14.3.10.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.3.10.4. Market Revenue and Forecast, by Material (2017-2030)

14.3.10.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.3.10.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.3.10.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.3.11. Rest of APAC

14.3.11.1. Market Revenue and Forecast, by Product (2017-2030)

14.3.11.2. Market Revenue and Forecast, by Application (2017-2030)

14.3.11.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.3.11.4. Market Revenue and Forecast, by Material (2017-2030)

14.3.11.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.3.11.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.3.11.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.4. MEA

14.4.1. Market Revenue and Forecast, by Product (2017-2030)

14.4.2. Market Revenue and Forecast, by Application (2017-2030)

14.4.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.4.4. Market Revenue and Forecast, by Material (2017-2030)

14.4.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.4.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.4.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.4.8. GCC

14.4.8.1. Market Revenue and Forecast, by Product (2017-2030)

14.4.8.2. Market Revenue and Forecast, by Application (2017-2030)

14.4.8.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.4.8.4. Market Revenue and Forecast, by Material (2017-2030)

14.4.8.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.4.8.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.4.8.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.4.9. North Africa

14.4.9.1. Market Revenue and Forecast, by Product (2017-2030)

14.4.9.2. Market Revenue and Forecast, by Application (2017-2030)

14.4.9.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.4.9.4. Market Revenue and Forecast, by Material (2017-2030)

14.4.9.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.4.9.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.4.9.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.4.10. South Africa

14.4.10.1. Market Revenue and Forecast, by Product (2017-2030)

14.4.10.2. Market Revenue and Forecast, by Application (2017-2030)

14.4.10.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.4.10.4. Market Revenue and Forecast, by Material (2017-2030)

14.4.10.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.4.10.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.4.10.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.4.11. Rest of MEA

14.4.11.1. Market Revenue and Forecast, by Product (2017-2030)

14.4.11.2. Market Revenue and Forecast, by Application (2017-2030)

14.4.11.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.4.11.4. Market Revenue and Forecast, by Material (2017-2030)

14.4.11.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.4.11.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.4.11.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.5. Latin America

14.5.1. Market Revenue and Forecast, by Product (2017-2030)

14.5.2. Market Revenue and Forecast, by Application (2017-2030)

14.5.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.5.4. Market Revenue and Forecast, by Material (2017-2030)

14.5.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.5.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.5.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.5.8. Brazil

14.5.8.1. Market Revenue and Forecast, by Product (2017-2030)

14.5.8.2. Market Revenue and Forecast, by Application (2017-2030)

14.5.8.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.5.8.4. Market Revenue and Forecast, by Material (2017-2030)

14.5.8.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.5.8.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.5.8.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.5.9. Rest of LATAM

14.5.9.1. Market Revenue and Forecast, by Product (2017-2030)

14.5.9.2. Market Revenue and Forecast, by Application (2017-2030)

14.5.9.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.5.9.4. Market Revenue and Forecast, by Material (2017-2030)

14.5.9.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.5.9.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.5.9.7. Market Revenue and Forecast, by Vehicle (2017-2030)

Chapter 15. Company Profiles

15.1. Bulten AB

15.1.1. Company Overview

15.1.2. Product Offerings

15.1.3. Financial Performance

15.1.4. Recent Initiatives

15.2. KAMAX

15.2.1. Company Overview

15.2.2. Product Offerings

15.2.3. Financial Performance

15.2.4. Recent Initiatives

15.3. Sundram Fasteners

15.3.1. Company Overview

15.3.2. Product Offerings

15.3.3. Financial Performance

15.3.4. Recent Initiatives

15.4. Stanley Black & Decker

15.4.1. Company Overview

15.4.2. Product Offerings

15.4.3. Financial Performance

15.4.4. Recent Initiatives

15.5. Shanghai Prime Machinery Company

15.5.1. Company Overview

15.5.2. Product Offerings

15.5.3. Financial Performance

15.5.4. Recent Initiatives

15.6. SFS Group

15.6.1. Company Overview

15.6.2. Product Offerings

15.6.3. Financial Performance

15.6.4. Recent Initiatives

15.7. Lisi Group

15.7.1. Company Overview

15.7.2. Product Offerings

15.7.3. Financial Performance

15.7.4. Recent Initiatives

15.8. The Philips Screw Company

15.8.1. Company Overview

15.8.2. Product Offerings

15.8.3. Financial Performance

15.8.4. Recent Initiatives

15.9. KOVA Fasteners Private Limited

15.9.1. Company Overview

15.9.2. Product Offerings

15.9.3. Financial Performance

15.9.4. Recent Initiatives

15.10. Westfield Fasteners Limited

15.10.1. Company Overview

15.10.2. Product Offerings

15.10.3. Financial Performance

15.10.4. Recent Initiatives

Chapter 16. Research Methodology

16.1. Primary Research

16.2. Secondary Research

16.3. Assumptions

Chapter 17. Appendix

17.1. About Us

17.2. Glossary of Terms

Buy Full Research Report (Single User License US$ 4500) @ https://www.precedenceresearch.com/checkout/1611

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

0 Comments