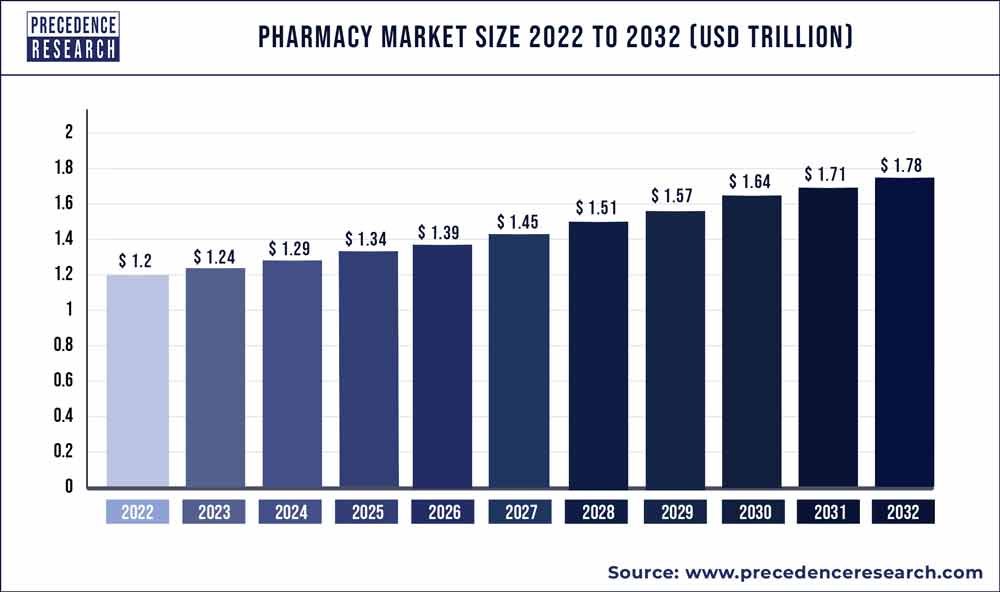

The global pharmacy market size is expected to reach around US$1,627.74 billion by 2030 from US$1,073.23 billion in 2021 and is expected to grow at an impressive double-digit rate of 4.7% from 2022 to 2030.

The study includes drivers and restraints of this market. The study provides an analysis of the global pharmacy market for the period 2017-2030, wherein 2022 to 2030 is the forecast period and 2021 is considered as the base year.

The increasing rate of consumers being affected by diseases, increasing elderly people, and growing variety of prescriptions are few among the major parameter driving the global pharmacy market. In respect to the Countrywide Health Services, the price of prescribed medicines in the FY 2020-21 increased by 3.46% as compared to FY 2019-20 in UK. As mentioned by the Centre for Disease Handle and Prevention, 45.7% of the consumers in U.S. used at least prescription drug for the minimum of at least one from the year 2015 to 2018, while more than 20% of the people consumed more than three prescription drugs in the same period.

Download Free Sample Copy Here (Including TOC, List of Tables & Figures, and Chart) @ https://www.precedenceresearch.com/sample/1568

Market Estimations Y-O-Y:

- Market Size Was Valued In 2021: US$ 1,073.23 Billion

- Market Size Is Projected to Grow By 2022: US$ 1,123.18 Billion

- Market Size Is Projected to Grow By 2023: US$ 1175.69 Billion

- Market Size Is Projected to Grow By 2024: US$ 1,230.89 Billion

- Market Size Is Projected to Grow By 2025: US$ 1288.93 Billion

- Market Size Is Projected to Grow By 2026: US$ 1349.98 Billion

- Market Size Is Projected to Grow By 2027: US$ 1414.21 Billion

- Market Size Is Projected to Grow By 2028: US$ 1481.78 Billion

- Market Size Is Projected to Grow By 2029: US$ 1552.89 Billion

- Market Size Is Projected to Grow By 2030: US$ 1,627.74 Billion

- Compound Annual Growth Rate (CAGR) from 2022 to 2030: 4.7 percent

Report Highlights

- The E-pharmacy segment is expected to grow with fastest CAGR in during the forecast time period. With the occurrence of COVID-19 pandemic, adoption of online pharmacies increased. Post-pandemic, consumers will continue adopting e-pharmacies because of benefits, such as affordability, accessibility, and convenience

- In 2020, the prescription product type segment had the highest revenue share of more than 80%.The rising prevalence of chronic diseases, as well as the ageing population, is pushing up prescription drug demand.

Market Dynamics

Driver

Availability of Health and Wellness services in Pharmacies Increasing Consumer Base of Pharmacies

Over the past few years established industry players have invested hugely in delivering innovative and superior service, while pharmacies are focusing significantly towards increasing customer satisfaction by offering health and wellness services. The key driver of overall customer satisfaction is the availability of overall wellness services. Supply of these services is showing improvement in overall customer satisfaction. These kinds of services are at present seen in 86% of chain drug stores, 83% of superstore pharmacies and 73% of mass merchandiser medical stores in U.S. Many pharmacies are focusing on on-time delivery through mail orders Customer satisfaction is highest when they get a health professional prescribed medicines ready/delivered when assured. Such innovative services provided by pharmacies are driving the market growth.

Restraint

Increasing competition From E-pharmacies to pose Major Threat for Retail Pharmacies

Competition in the pharmacy industry is projected to intensify in the approaching years, especially from big-box merchants and mail-order and online pharmacies. Payors also have piloted consumers email ordering, such as by covering a 3 month supply of medications sent to the home just a 30-day supply offered at a brick-and-mortar drug-store. Finally, Internet medical stores are aggressively focusing on cash-paying customers by providing medications at a lower cost.

The multinational companies such as Amazon entering in E-pharmacy segment is a menace to retail medical stores on multiple methodologies. Amazon entered into the health professional prescribed industry with their 2018 acquisition of PillPack and the 2020 launching of Amazon Pharmacy and an Amazon Excellent prescription discount profit. And furthermore Amazon is planning to create physical pharmacies. With such moves Amazon will still be a thorn in the side and tension on the underside line of list pharmacies. This factor may act as a major threat for the expansion of retail pharmacies.

Opportunity

Innovations in Technology Evolving Pharmacy Industry

Innovation in technology may provide promising opportunities for the market growth of pharmacy market during forecast time period. For years, researchers have been working on smart mirrors that utilize advanced cameras and customer’s breadth to detect health variations and smart toilets. Several companies are testing and developing basic home health care bots, and elderly workers in Japan are already wearing exoskeletons to help them perform manual labor.

Smartphones are progressing to the point where they can be used as point-of-care and home health diagnostic tools for ailments including urinary tract infections6 and diabetic eye disease. Labs have created an ingestible origami robot that can be swallowed and controlled to, for example, patch a wound, and are experimenting with xenobots, programmable organisms made from frog stem cells that could deliver medicine. As pharmaceutical are innovating and competing in the growing pharmacy market planning, adapting, and investing for the future offers lucrative opportunities.

Challenge

Low Margins for Pharmacy Owners Challenging Growth in Sales Value

Retail pharmacies are likely to face downward stresses on their profitability. Compensation is tightening and costs are on the rise for everything from wages to rent to more cumbersome certification and licensing requirements. In addition, medical stores have found themselves pushed to purchase new technology and products that can help keep them up to date and competitive. All this contributes to constantly shrinking margins that threaten long-term stability.

Why should you invest in this report?

If you are aiming to enter the global pharmacy market, this report is a comprehensive guide that provides crystal clear insights into this niche market. All the major application areas for pharmacy are covered in this report and information is given on the important regions of the world where this market is likely to boom during the forecast period of 2022-2030, so that you can plan your strategies to enter this market accordingly.

Besides, through this report, you can have a complete grasp of the level of competition you will be facing in this hugely competitive market and if you are an established player in this market already, this report will help you gauge the strategies that your competitors have adopted to stay as market leaders in this market. For new entrants to this market, the voluminous data provided in this report is invaluable.

Some of the prominent players in the global pharmacy market include:

- CVS Health

- Boots Walgreens

- Cigna

- Walmart

- Kroger

- Rite Aid Corp.

- Lloyd Pharmacy

- Well Pharmacy

- Humana Pharmacy Solutions

- Matsumoto Kiyoshi

Segments Covered in the Report

By Product Type

- Prescription

- OTC

By Pharmacy Type

- Retail

- E-pharmacy

By Application

- Hospital-grade

- Personal Use

Regional Analysis:

The geographical analysis of the global pharmacy market has been done for North America, Europe, Asia-Pacific, and the Rest of the World.

The North American Market is again segmented into the US, Canada, and Mexico. Coming to the European Market, it can be segmented further into the UK, Germany, France, Italy, Spain, and the rest. Coming to the Asia-Pacific, the global pharmacy Market is segmented into China, India, Japan, and Rest of Asia Pacific. Among others, the market is segmented into the Middle East and Africa, (GCC, North Africa, South Africa and Rest of the Middle East & Africa).

Key Questions Answered by the Report:

- What will be the size of the global pharmacy market in 2030?

- What is the expected CAGR for the pharmacy market between 2021 and 2030?

- Which are the top players active in this global market?

- What are the key drivers of this global market?

- How will the market situation change in the coming years?

- Which region held the highest market share in this global market?

- What are the common business tactics adopted by players?

- What is the growth outlook of the global pharmacy market?

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Pharmacy Market

5.1. COVID-19 Landscape: Pharmacy Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Pharmacy Market, By Product

8.1. Pharmacy Market, by Product Type, 2022-2030

8.1.1. Prescription

8.1.1.1. Market Revenue and Forecast (2019-2030)

8.1.2. OTC

8.1.2.1. Market Revenue and Forecast (2019-2030)

Chapter 9. Global Pharmacy Market, By Application

9.1. Pharmacy Market, by Application, 2022-2030

9.1.1. Hospital-grade

9.1.1.1. Market Revenue and Forecast (2019-2030)

9.1.2. Personal Use

9.1.2.1. Market Revenue and Forecast (2019-2030)

Chapter 10. Global Pharmacy Market, By Pharmacy

10.1. Pharmacy Market, by Pharmacy, 2022-2030

10.1.1. Retail

10.1.1.1. Market Revenue and Forecast (2019-2030)

10.1.2. E-pharmacy

10.1.2.1. Market Revenue and Forecast (2019-2030)

Chapter 11. Global Pharmacy Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2019-2030)

11.1.2. Market Revenue and Forecast, by Application (2019-2030)

11.1.3. Market Revenue and Forecast, by Pharmacy (2019-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2019-2030)

11.1.4.2. Market Revenue and Forecast, by Application (2019-2030)

11.1.4.3. Market Revenue and Forecast, by Pharmacy (2019-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2019-2030)

11.1.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.1.5.3. Market Revenue and Forecast, by Pharmacy (2019-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2019-2030)

11.2.2. Market Revenue and Forecast, by Application (2019-2030)

11.2.3. Market Revenue and Forecast, by Pharmacy (2019-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2019-2030)

11.2.4.2. Market Revenue and Forecast, by Application (2019-2030)

11.2.4.3. Market Revenue and Forecast, by Pharmacy (2019-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2019-2030)

11.2.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.2.5.3. Market Revenue and Forecast, by Pharmacy (2019-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2019-2030)

11.2.6.2. Market Revenue and Forecast, by Application (2019-2030)

11.2.6.3. Market Revenue and Forecast, by Pharmacy (2019-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2019-2030)

11.2.7.2. Market Revenue and Forecast, by Application (2019-2030)

11.2.7.3. Market Revenue and Forecast, by Pharmacy (2019-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2019-2030)

11.3.2. Market Revenue and Forecast, by Application (2019-2030)

11.3.3. Market Revenue and Forecast, by Pharmacy (2019-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2019-2030)

11.3.4.2. Market Revenue and Forecast, by Application (2019-2030)

11.3.4.3. Market Revenue and Forecast, by Pharmacy (2019-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2019-2030)

11.3.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.3.5.3. Market Revenue and Forecast, by Pharmacy (2019-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2019-2030)

11.3.6.2. Market Revenue and Forecast, by Application (2019-2030)

11.3.6.3. Market Revenue and Forecast, by Pharmacy (2019-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2019-2030)

11.3.7.2. Market Revenue and Forecast, by Application (2019-2030)

11.3.7.3. Market Revenue and Forecast, by Pharmacy (2019-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2019-2030)

11.4.2. Market Revenue and Forecast, by Application (2019-2030)

11.4.3. Market Revenue and Forecast, by Pharmacy (2019-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2019-2030)

11.4.4.2. Market Revenue and Forecast, by Application (2019-2030)

11.4.4.3. Market Revenue and Forecast, by Pharmacy (2019-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2019-2030)

11.4.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.4.5.3. Market Revenue and Forecast, by Pharmacy (2019-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2019-2030)

11.4.6.2. Market Revenue and Forecast, by Application (2019-2030)

11.4.6.3. Market Revenue and Forecast, by Pharmacy (2019-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2019-2030)

11.4.7.2. Market Revenue and Forecast, by Application (2019-2030)

11.4.7.3. Market Revenue and Forecast, by Pharmacy (2019-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2019-2030)

11.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.5.3. Market Revenue and Forecast, by Pharmacy (2019-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2019-2030)

11.5.4.2. Market Revenue and Forecast, by Application (2019-2030)

11.5.4.3. Market Revenue and Forecast, by Pharmacy (2019-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2019-2030)

11.5.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.5.5.3. Market Revenue and Forecast, by Pharmacy (2019-2030)

Chapter 12. Company Profiles

12.1. CVS Health

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Boots Walgreens

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Cigna

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Walmart

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Kroger

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Rite Aid Corp.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Lloyd Pharmacy

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Well Pharmacy

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Humana Pharmacy Solutions

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Matsumoto Kiyoshi

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Buy Full Research Report (Single User License US$ 4500) @ https://www.precedenceresearch.com/checkout/1568

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

0 Comments