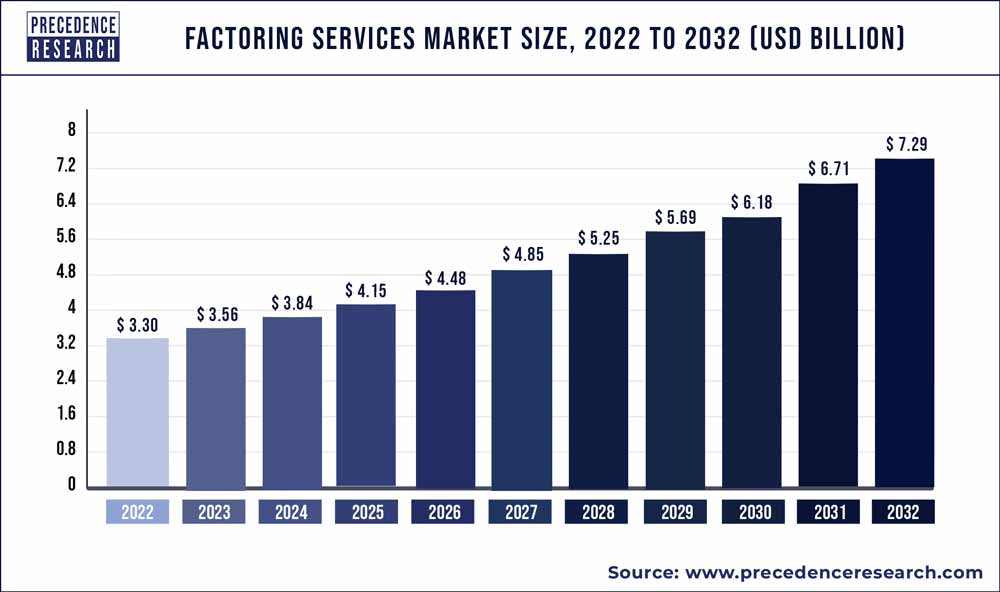

Precedence Research analyzes the new publication titled “Factoring Services Market (By Category: Domestic Factoring and International Factoring; By Type: Recourse Factoring and Non-recourse Factoring; By Application: Small & Medium Enterprise (SMEs) and Large Enterprise) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2021 – 2030”, As per the report, the factoring services market size was US$ 5.7 billion in 2020. It is projected to grow US$ 12.05 billion by 2030 at a CAGR of 7.8% in the forecast period.

Download the FREE Sample Report (Including TOC, List of Tables & Figures, and Chart) @ https://www.precedenceresearch.com/sample/1417

Market Overview

A recent study by Precedence Research on the factoring services market offers a forecast for 2021 and 2030. The study analyzes crucial trends that are currently determining the growth of the factoring services market. This report explicates on vital dynamics such as the drivers, restraints, and opportunities for key market players, along with key stakeholders as well as emerging players associated with the manufacturing of factoring services. The study also provides the dynamics that are responsible for influencing the future status of this market over the forecast period.

A detailed assessment of the factoring services market value chain analysis, business execution, and supply chain analysis across regional markets has been covered in the report. A list of prominent companies operating in the factoring services market along with their product portfolio enhances the reliability of this comprehensive research study.

Highlights of the Report:

- Market Penetration: Comprehensive information on the product portfolios of the top players in the market.

- Product Development/Innovation: Detailed insights on the upcoming technologies, R&D activities, and product launches in the market

- Competitive Assessment: In-depth assessment of the market strategies, geographic and business segments of the leading players in the market

- Market Development: Comprehensive information about emerging markets. This report analyzes the market for various segments across geographies

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the market

Key Points

- Primary Research

- Secondary Research

- Market Size Estimation

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Challenges

- Macroeconomic Indicators

- Technology Trends and Assessment

- Market Factor Analysis

- Porter’s Five Forces Analysis

- Bargaining Power Of Suppliers

- Bargaining Power Of Buyers

- Threat Of New Entrants

- Threat Of Substitutes

- Intensity Of Rivalry

- Value Chain Analysis

- Investment Feasibility Analysis

- Pricing Analysis

Research Methodology

Secondary Research

It involves company databases such as Hoover's: This assists us recognize financial information, the structure of the market participants and industry's competitive landscape.

The secondary research sources referred in the process are as follows:

- Governmental bodies, and organizations creating economic policies

- National and international social welfare institutions

- Company websites, financial reports and SEC filings, broker and investor reports

- Related patent and regulatory databases

- Statistical databases and market reports

- Corporate Presentations, news, press release, and specification sheet of Manufacturers

Primary Research

Primary research includes face-to-face interviews, online surveys, and telephonic interviews.

- Means of primary research: Email interactions, telephonic discussions and Questionnaire-based research etc.

- In order to validate our research findings and analysis we conduct primary interviews of key industry participants. Insights from primary respondents help in validating the secondary research findings. It also develops Research Team’s expertise and market understanding.

Industry participants involved in this research study include:

- CEOs, VPs, market intelligence managers

- Procuring and national sales managers technical personnel, distributors and resellers

- Research analysts and key opinion leaders from various domains

Competition Landscape

In the final section of the report on the global factoring services market, a 'dashboard view' of the companies has been provided to compare the current market scenario and the contribution of companies to the global factoring services market. Moreover, the report is primarily designed to provide clients with an objective and detailed comparative assessment of key providers specific to segments of the global market. Report audiences can gain segment-specific manufacturer insights to identify and evaluate key competitors based on an in-depth assessment of their capabilities and success in the factoring services marketplace.

Some of the prominent players in the global factoring services market include:

- The Southern Banc Co. Inc

- Advanon AG

- BNP Paribas Cardiff

- Mizuho Financial Group Inc.

- Deutsche Leasing AG

- Riviera Finance of Texas Inc.

- SocieteGenerale SA

- Eurobank Ergasias SA

- Hitachi Capital PLC

- Triumph Business Capital

Market Segmentation

Segments of the global factoring services market have been analyzed in terms of their market share to understand an individual segment’s relative contribution to market growth. This detailed level of information is important for identifying key trends in the global factoring services market.

Market Segments as below:

By Category

- Domestic Factoring

- International Factoring

By Type

- Recourse Factoring

- Non-recourse Factoring

By Application

- Small and Medium Enterprise (SMEs)

- Large Enterprise

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Table of Content

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Factoring Services Market

5.1. COVID-19 Landscape: Factoring Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Factoring Services Market, By Category

8.1. Factoring Services Market, by Category Type, 2021-2030

8.1.1. Domestic Factoring

8.1.1.1. Market Revenue and Forecast (2019-2030)

8.1.2. International Factoring

8.1.2.1. Market Revenue and Forecast (2019-2030)

Chapter 9. Global Factoring Services Market, By Application

9.1. Factoring Services Market, by Application, 2021-2030

9.1.1. Small and Medium Enterprise (SMEs)

9.1.1.1. Market Revenue and Forecast (2019-2030)

9.1.2. Large Enterprise

9.1.2.1. Market Revenue and Forecast (2019-2030)

Chapter 10. Global Factoring Services Market, By Type

10.1. Factoring Services Market, by Type, 2021-2030

10.1.1. Recourse Factoring

10.1.1.1. Market Revenue and Forecast (2019-2030)

10.1.2. Non-recourse Factoring

10.1.2.1. Market Revenue and Forecast (2019-2030)

Chapter 11. Global Factoring Services Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Category (2019-2030)

11.1.2. Market Revenue and Forecast, by Application (2019-2030)

11.1.3. Market Revenue and Forecast, by Type (2019-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Category (2019-2030)

11.1.4.2. Market Revenue and Forecast, by Application (2019-2030)

11.1.4.3. Market Revenue and Forecast, by Type (2019-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Category (2019-2030)

11.1.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.1.5.3. Market Revenue and Forecast, by Type (2019-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Category (2019-2030)

11.2.2. Market Revenue and Forecast, by Application (2019-2030)

11.2.3. Market Revenue and Forecast, by Type (2019-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Category (2019-2030)

11.2.4.2. Market Revenue and Forecast, by Application (2019-2030)

11.2.4.3. Market Revenue and Forecast, by Type (2019-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Category (2019-2030)

11.2.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.2.5.3. Market Revenue and Forecast, by Type (2019-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Category (2019-2030)

11.2.6.2. Market Revenue and Forecast, by Application (2019-2030)

11.2.6.3. Market Revenue and Forecast, by Type (2019-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Category (2019-2030)

11.2.7.2. Market Revenue and Forecast, by Application (2019-2030)

11.2.7.3. Market Revenue and Forecast, by Type (2019-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Category (2019-2030)

11.3.2. Market Revenue and Forecast, by Application (2019-2030)

11.3.3. Market Revenue and Forecast, by Type (2019-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Category (2019-2030)

11.3.4.2. Market Revenue and Forecast, by Application (2019-2030)

11.3.4.3. Market Revenue and Forecast, by Type (2019-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Category (2019-2030)

11.3.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.3.5.3. Market Revenue and Forecast, by Type (2019-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Category (2019-2030)

11.3.6.2. Market Revenue and Forecast, by Application (2019-2030)

11.3.6.3. Market Revenue and Forecast, by Type (2019-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Category (2019-2030)

11.3.7.2. Market Revenue and Forecast, by Application (2019-2030)

11.3.7.3. Market Revenue and Forecast, by Type (2019-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Category (2019-2030)

11.4.2. Market Revenue and Forecast, by Application (2019-2030)

11.4.3. Market Revenue and Forecast, by Type (2019-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Category (2019-2030)

11.4.4.2. Market Revenue and Forecast, by Application (2019-2030)

11.4.4.3. Market Revenue and Forecast, by Type (2019-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Category (2019-2030)

11.4.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.4.5.3. Market Revenue and Forecast, by Type (2019-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Category (2019-2030)

11.4.6.2. Market Revenue and Forecast, by Application (2019-2030)

11.4.6.3. Market Revenue and Forecast, by Type (2019-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Category (2019-2030)

11.4.7.2. Market Revenue and Forecast, by Application (2019-2030)

11.4.7.3. Market Revenue and Forecast, by Type (2019-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Category (2019-2030)

11.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.5.3. Market Revenue and Forecast, by Type (2019-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Category (2019-2030)

11.5.4.2. Market Revenue and Forecast, by Application (2019-2030)

11.5.4.3. Market Revenue and Forecast, by Type (2019-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Category (2019-2030)

11.5.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.5.5.3. Market Revenue and Forecast, by Type (2019-2030)

Chapter 12. Company Profiles

12.1. The Southern Banc Co. Inc

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Advanon AG

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. BNP Paribas Cardiff

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Mizuho Financial Group Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Deutsche Leasing AG

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Riviera Finance of Texas Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. SocieteGenerale SA

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Eurobank Ergasias SA

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Hitachi Capital PLC

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Triumph Business Capital

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

Why Buy this Report?

The purpose of Precedence Research's factoring services market study is to provide stakeholders with a detailed picture of potential barriers and untapped opportunities. The report contains exclusive information to assist businesses in making informed decisions about how to maintain growth throughout the assessment period.

Buy Full Research Report (Single User License US$ 4500) @ https://www.precedenceresearch.com/checkout/1417

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

0 Comments