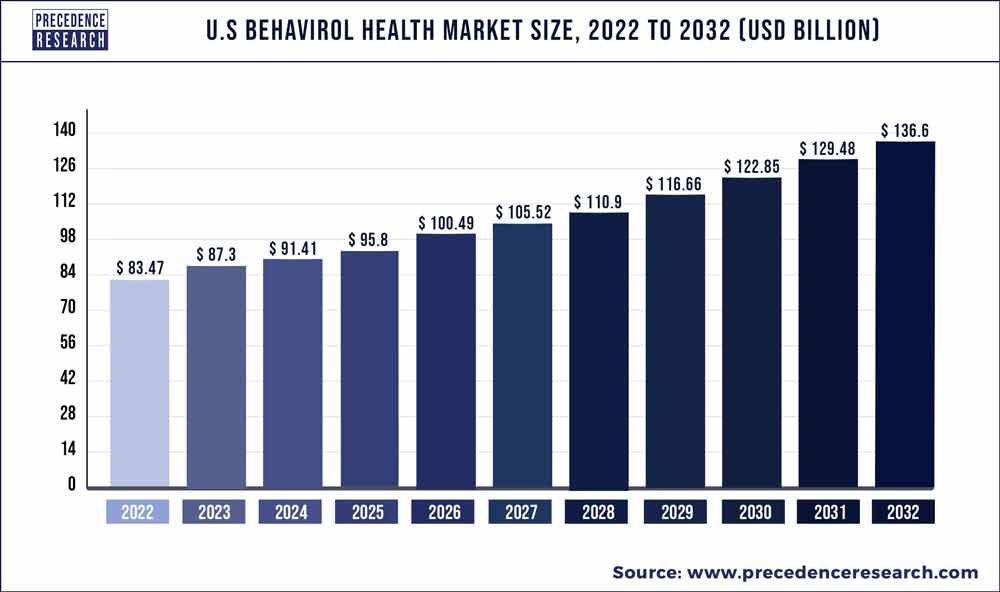

The global U.S. behavioral health market size is expected to reach around US$ 132.4 billion by 2027 from US$ 90.5 billion in 2020 and is expected to grow at an impressive double-digit rate of 5.3% from 2021 to 2027.

The study includes drivers and restraints of this market. The study provides an analysis of the global U.S. behavioral health market for the period 2017-2027, wherein 2021 to 2027 is the forecast period and 2020 is considered as the base year.

We customize your report according to your research need. REQUEST CUSTOMIZED COPY OF REPORT (Including TOC, List of Tables & Figures, and Chart) @ https://www.precedenceresearch.com/customization/1320

Home-based treatment services

Instead of being held in an office, home-based therapy takes place in the house of the individual receiving treatment. People who have trouble going to private practices or mental health facilities may benefit from it. Money concerns, age, chronic medical issues, agoraphobia, and responsibilities at home or work are all factors that may prevent someone from seeking treatment.

Many home-based rehabilitation programs are available through community health groups and child protective agencies. Whether or not access to care is a concern, private practice therapists may offer in-home sessions if it appears to be the most helpful method of treatment.

Home-based treatment can be provided by psychologists, psychiatrists, marriage and family therapists, counselors, social workers, and other mental health experts. In a session, a variety of approaches may be used. Individual treatment, couples’ therapy, play therapy, and family therapy are some of the options.

US Behavioral Health Market Share, By Service, 2020 (%)

| Service Segment | 2020 (%) | |

| Home-Based Treatment Services | 15.3 | % |

| Outpatient counseling | 35.1 | % |

| Emergency mental health services | 8.6 | % |

| Inpatient hospital treatment | 22 | % |

| Intensive care management | 19 | % |

Outpatient counseling

Outpatient mental health treatments can include one or more mental health therapies that do not require a lengthy stay in an institution. Patients who receive treatment in outpatient care learn to cope with pressures and regulate their mental health. Counseling, group therapy, medical consultations, and psychiatry are examples of these services. Short-term counseling to long-term care regimens that include therapy and/or medication is all options for treatment.

Outpatient care is the most popular treatment for many mental health issues since it is less expensive, more flexible with patients' requirements and schedules, and has a broader provider pool. Outpatient treatment should be used only when continuous support is not required and it is healthier for the patient to remain in their natural surroundings to face stressors and learn to manage with expert assistance. For people suffering from eating disorders, depression, or anxiety, this is frequently the best course of action.

Emergency mental health services

A mental health crisis occurs when a person's thoughts, emotions, and behaviors put them in danger of injuring themselves or others, or when they are unable to care for themselves or obtain food, clothing, or shelter. Acute conditions that could soon worsen into dangerousness or inability to care for oneself are also included in crises, even if they are not currently a concern. A mental health crisis can occur anywhere—in public, at home or work, or in a variety of clinical settings.

Emergency mental health services are an important aspect of a mental health hospital. Patients who are addicted to alcohol or drugs, schizophrenic, depressed, or suffer from panic attacks as a result of anxiety are frequently dealt with by family and caregivers. Several hospitals have hotlines as part of emergency mental health services.

US Behavioral Health Pre-COVID-19 Market Size and Estimations, By Service, 2016-2020 (USD Billion)

| Service Segment | 2016 | 2017 | 2018 | 2019 | 2020 |

| Home-Based Treatment Services | 9.06 | 9.06 | 10.89 | 11.87 | 13.86 |

| Outpatient counseling | 25.76 | 27.07 | 28.35 | 29.62 | 31.72 |

| Emergency mental health services | 6.42 | 6.73 | 7.04 | 7.34 | 7.64 |

| Inpatient hospital treatment | 16.29 | 17.13 | 17.97 | 18.80 | 19.61 |

| Intensive care management | 13.86 | 14.59 | 15.32 | 16.04 | 16.75 |

| Total | 71.39 | 75.48 | 79.57 | 83.66 | 87.75 |

Inpatient hospital treatment

Inpatient treatment is the most severe form of treatment for those with mental illnesses and addictions. It provides 24-hour care in a safe and secure environment, making it ideal for patients who require constant monitoring due to serious mental health or substance misuse concerns. Understanding the indicators of psychiatric disease, fast stabilization, devising methods to avoid re-hospitalization, and discharge planning are all priorities in the inpatient setting. Patients in inpatient treatment programs can work on regaining life skills without being exposed to negative influences that encourage them to continue their harmful behavior.

Acute inpatient care is still an important part of current mental health care. Despite their necessity, mental inpatient hospitals are still frequently perceived as terrifying environments, with overworked staff unable to deliver therapeutic care in an unpleasant physical environment.

Intensive care management

Intensive care management (ICM) is a community-based package of care aimed at providing long-term care for severely mentally ill patients who do not require emergency admission. ICM arose from two initial community-based care models, Assertive Community Treatment (ACT) and Case Management (CM), with ICM emphasizing the significance of a small caseload (less than 20) and high-intensity input.

Telehealth has been penetrating the ICM market segment gradually over the past few years. For instance, the Eastern Oklahoma VA Health Care System (EOVAHCS) with facilities in Tulsa and the rural areas of Muskogee, McAlester, Vinita, and Idabel, serves nearly 47,000 veterans in a 25-county region. Rural veterans in the intensive care unit (ICU) and emergency department will now have access to 24/7 remote patient monitoring thanks to a partnership between EOVAHCS and the Cincinnati VA Medical Center's Tele-ICU Monitoring Center.

Teleconferencing equipment is available in twelve ICU rooms and three emergency department rooms at EOVAHCS. EOVAHCS also features two portable units that can be used to connect from any room in the institution. This device allows critical care nurses to communicate with providers and other critical care nurses at the Cincinnati VA Medical Center. Providers and nursing staff can use teleconferencing to retrieve patients' bedside data, videoconference with patients, conduct consultations, and communicate with clinical professionals in the event of a medical emergency.

When a tele-ICU clinician or nurse enters a room virtually, the camera rotates to face the patient, allowing the provider and patient to converse. When the teleconference session is over, the camera goes off. Video is not recorded by the cameras.

Tele-ICU clinicians completed 11,058 video examinations on ICU patients at EOVAHCS from October 2019 to April 2021. This resulted in an additional 17,578 hours of assessment time by an Intensivist or a Certified Critical Care RN. This improves the quality of care delivered by bedside employees and adds another layer of support.

The emergency department (ED) has had difficulty using remote patient monitoring since the critical patient is not in a room equipped with the equipment. Staff members frequently use tele-ICU to report on patients who will be admitted to the ICU.

Due to camera failure, the tele-ICU team has been unable to visit patients due to technological issues. To address this, the facility's patient monitoring system in the ICU and ED has been modified.

Why should you invest in this report?

If you are aiming to enter the global U.S. behavioral health market, this report is a comprehensive guide that provides crystal clear insights into this niche market. All the major application areas for U.S. behavioral health are covered in this report and information is given on the important regions of the world where this market is likely to boom during the forecast period of 2021-2027, so that you can plan your strategies to enter this market accordingly.

Besides, through this report, you can have a complete grasp of the level of competition you will be facing in this hugely competitive market and if you are an established player in this market already, this report will help you gauge the strategies that your competitors have adopted to stay as market leaders in this market. For new entrants to this market, the voluminous data provided in this report is invaluable.

Some of the prominent players in the global U.S. behavioral health market include areAcadia Healthcare, Promises Behavioral Health (Elements Behavioral Health), Epic Health Services (Aveanna Healthcare), Universal Health Services, Behavioral Health Group, Inc., IBH Population Health Solutions, CuraLinc Healthcare, North Range Behavioral Health, Ardent Health Services and CRC Health Group.

Market Segmentation:

By Service

- Home-Based Treatment Services

- Outpatient counseling

- Emergency mental health services

- Inpatient hospital treatment

- Intensive care management

By Disorder

- Bipolar Disorder

- Anxiety Disorder

- Depression

- Post-Traumatic Stress Disorder

- Eating Disorder

- Substance Abuse Disorder

- Others

By End User

- Outpatient Clinics

- Hospitals

- Rehabilitation Centers

- Homecare Setting

Key Questions Answered by the Report:

- What will be the size of the global U.S. behavioral health market in 2027?

- What is the expected CAGR for the U.S. behavioral health market between 2021 and 2027?

- Which are the top players active in this global market?

- What are the key drivers of this global market?

- How will the market situation change in the coming years?

- Which region held the highest market share in this global market?

- What are the common business tactics adopted by players?

- What is the growth outlook of the global U.S. behavioral health market?

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Behavioral Health Market

5.1. COVID-19 Landscape: U.S. Behavioral Health Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Behavioral Health Market, By Service

8.1. U.S. Behavioral Health Market, by Service Type, 2021-2030

8.1.1. Home-Based Treatment Services

8.1.1.1. Market Revenue and Forecast (2019-2030)

8.1.2. Outpatient counseling

8.1.2.1. Market Revenue and Forecast (2019-2030)

8.1.3. Emergency mental health services

8.1.3.1. Market Revenue and Forecast (2019-2030)

8.1.4. Inpatient hospital treatment

8.1.4.1. Market Revenue and Forecast (2019-2030)

8.1.5. Intensive care management

8.1.5.1. Market Revenue and Forecast (2019-2030)

Chapter 9. U.S. Behavioral Health Market, By End User

9.1. U.S. Behavioral Health Market, by End User, 2021-2030

9.1.1. Outpatient Clinics

9.1.1.1. Market Revenue and Forecast (2019-2030)

9.1.2. Hospitals

9.1.2.1. Market Revenue and Forecast (2019-2030)

9.1.3. Rehabilitation Centers

9.1.3.1. Market Revenue and Forecast (2019-2030)

9.1.4. Homecare Setting

9.1.4.1. Market Revenue and Forecast (2019-2030)

Chapter 10. U.S. Behavioral Health Market, By Disorder

10.1. U.S. Behavioral Health Market, by Disorder, 2021-2030

10.1.1. Bipolar Disorder

10.1.1.1. Market Revenue and Forecast (2019-2030)

10.1.2. Anxiety Disorder

10.1.2.1. Market Revenue and Forecast (2019-2030)

10.1.3. Depression

10.1.3.1. Market Revenue and Forecast (2019-2030)

10.1.4. Post-Traumatic Stress Disorder

10.1.4.1. Market Revenue and Forecast (2019-2030)

10.1.5. Eating Disorder

10.1.5.1. Market Revenue and Forecast (2019-2030)

10.1.6. Substance Abuse Disorder

10.1.6.1. Market Revenue and Forecast (2019-2030)

10.1.7. Others

10.1.7.1. Market Revenue and Forecast (2019-2030)

Chapter 11. U.S. Behavioral Health Market, Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Service (2019-2030)

11.1.2. Market Revenue and Forecast, by End User (2019-2030)

11.1.3. Market Revenue and Forecast, by Disorder (2019-2030)

Chapter 12. Company Profiles

12.1. Acadia Healthcare

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Promises Behavioral Health (Elements Behavioral Health)

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Epic Health Services (Aveanna Healthcare)

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Universal Health Services

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Behavioral Health Group, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. IBH Population Health Solutions

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. CuraLinc Healthcare

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. North Range Behavioral Health

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Ardent Health Services

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. CRC Health Group

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Buy Full Research Report (Single User License US$ 4500) @ https://www.precedenceresearch.com/checkout/1320

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

0 Comments