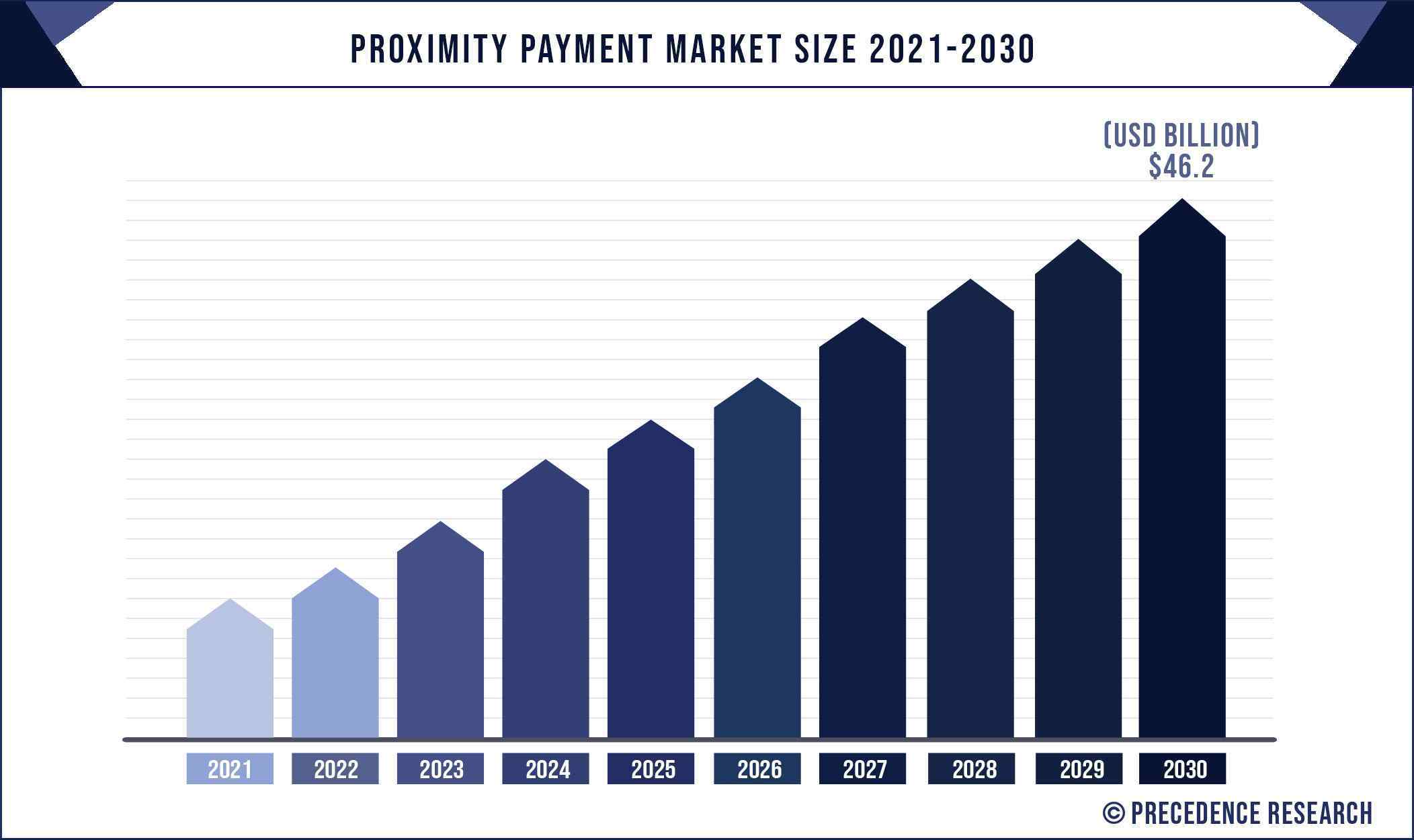

The global proximity payment market size is expected to reach around US$ 46.2 billion by 2030 from US$ 13.97 billion in 2021 and is expected to grow at an impressive double-digit rate of 13.2% from 2021 to 2030.

The study includes drivers and restraints of this market. The study provides an analysis of the global proximity payment market for the period 2017-2030, wherein 2021 to 2030 is the forecast period and 2020 is considered as the base year.

We customize your report according to your research need. REQUEST CUSTOMIZED COPY OF REPORT (Including TOC, List of Tables & Figures, and Chart) @ https://www.precedenceresearch.com/customization/1334

The major benefits that is provided by the proximity payment systems include flexibility of payment devices, reduced transaction time, Real-time transaction processing and increase in convenience. All these factors are expected to drive the growth of the market. Moreover, the massive adoptions of proximity payments among the merchants and the surge in the usage of the Smartphone that facilitate the proximity payments are some of the attributes that contributes significantly towards the market growth. For instance, On 24th June 2021, FIS, a financial technology pioneer, announced that USALLIANCE Financial, based in Rye, New York, has chosen the FIS Payments One platform to streamline and modernize its credit and debit card digital payment options for its members. Payments from the FIS One platform combines credit and debit card processing, loyalty, fraud protection, and card manufacturing into a single programmed. This will help USALLIANCE Financial to benefits form the robust capabilities of FIS’ Payments One to streamline and modernize its portfolio of card offerings.

Scope of the Proximity Payment Market Report

| Report Highlights | Details |

| Market Size | USD 46.2 Billion by 2030 |

| Growth Rate | CAGR of 13.2% From 2021 to 2030 |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Europe |

| Base Year | 2021 |

| Forecast Period | 2021 to 2030 |

| Segments Covered | Offering, Application, Geography |

| Companies Mentioned | ACI Worldwide Inc., Alphabet Inc., Apple Inc., FIS, IDEMIA, Ingenico, Mastercard, PayPal Holdings Inc., Square Inc. and Visa Inc. |

Why should you invest in this report?

If you are aiming to enter the global proximity payment market, this report is a comprehensive guide that provides crystal clear insights into this niche market. All the major application areas for proximity payment are covered in this report and information is given on the important regions of the world where this market is likely to boom during the forecast period of 2021-2030, so that you can plan your strategies to enter this market accordingly.

Besides, through this report, you can have a complete grasp of the level of competition you will be facing in this hugely competitive market and if you are an established player in this market already, this report will help you gauge the strategies that your competitors have adopted to stay as market leaders in this market. For new entrants to this market, the voluminous data provided in this report is invaluable.

Some of the prominent players in the global proximity payment market include:

- ACI Worldwide Inc.

- Alphabet Inc.

- Apple Inc.

- FIS

- IDEMIA

- Ingenico

- Mastercard

- PayPal Holdings Inc.

- Square Inc.

- Visa Inc.

Market Segmentation:

Segments Covered in the Report

By Offering

- Solution

- Hardware

- Software

- Service

By Application

- Grocery Stores

- Bars & Restaurants

- Drug Stores

- Entertainment Centers

- Others

By Geography

- North America

- U.S.

- Canada

- Mexico

- Europe

- U.K.

- Germany

- France

- Russia

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Latin America

- Middle East

- Africa

Regional Analysis:

The geographical analysis of the global proximity payment market has been done for North America, Europe, Asia-Pacific, and the Rest of the World.

The North American Market is again segmented into the US, Canada, and Mexico. Coming to the European Market, it can be segmented further into the UK, Germany, France, Italy, Spain, and the rest. Coming to the Asia-Pacific, the global proximity payment Market is segmented into China, India, Japan, and Rest of Asia Pacific. Among others, the market is segmented into the Middle East and Africa, (GCC, North Africa, South Africa and Rest of the Middle East & Africa).

Key Questions Answered by the Report:

- What will be the size of the global proximity payment market in 2030?

- What is the expected CAGR for the proximity payment market between 2021 and 2030?

- Which are the top players active in this global market?

- What are the key drivers of this global market?

- How will the market situation change in the coming years?

- Which region held the highest market share in this global market?

- What are the common business tactics adopted by players?

- What is the growth outlook of the global proximity payment market?

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Proximity Payment Market

5.1. COVID-19 Landscape: Proximity Payment Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Proximity Payment Market, By Offering

8.1. Proximity Payment Market, by Offering Type, 2021-2030

8.1.1. Solution (Hardware, Software)

8.1.1.1. Market Revenue and Forecast (2019-2030)

8.1.2. Service

8.1.2.1. Market Revenue and Forecast (2019-2030)

Chapter 9. Global Proximity Payment Market, By Application

9.1. Proximity Payment Market, by Application, 2021-2030

9.1.1. Grocery Stores

9.1.1.1. Market Revenue and Forecast (2019-2030)

9.1.2. Bars & Restaurants

9.1.2.1. Market Revenue and Forecast (2019-2030)

9.1.3. Drug Stores

9.1.3.1. Market Revenue and Forecast (2019-2030)

9.1.4. Entertainment Centers

9.1.4.1. Market Revenue and Forecast (2019-2030)

Chapter 10. Global Proximity Payment Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Offering (2019-2030)

10.1.2. Market Revenue and Forecast, by Application (2019-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Offering (2019-2030)

10.1.3.2. Market Revenue and Forecast, by Application (2019-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Offering (2019-2030)

10.1.4.2. Market Revenue and Forecast, by Application (2019-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Offering (2019-2030)

10.2.2. Market Revenue and Forecast, by Application (2019-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Offering (2019-2030)

10.2.3.2. Market Revenue and Forecast, by Application (2019-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Offering (2019-2030)

10.2.4.2. Market Revenue and Forecast, by Application (2019-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Offering (2019-2030)

10.2.5.2. Market Revenue and Forecast, by Application (2019-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Offering (2019-2030)

10.2.6.2. Market Revenue and Forecast, by Application (2019-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Offering (2019-2030)

10.3.2. Market Revenue and Forecast, by Application (2019-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Offering (2019-2030)

10.3.3.2. Market Revenue and Forecast, by Application (2019-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Offering (2019-2030)

10.3.4.2. Market Revenue and Forecast, by Application (2019-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Offering (2019-2030)

10.3.5.2. Market Revenue and Forecast, by Application (2019-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Offering (2019-2030)

10.3.6.2. Market Revenue and Forecast, by Application (2019-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Offering (2019-2030)

10.4.2. Market Revenue and Forecast, by Application (2019-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Offering (2019-2030)

10.4.3.2. Market Revenue and Forecast, by Application (2019-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Offering (2019-2030)

10.4.4.2. Market Revenue and Forecast, by Application (2019-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Offering (2019-2030)

10.4.5.2. Market Revenue and Forecast, by Application (2019-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Offering (2019-2030)

10.4.6.2. Market Revenue and Forecast, by Application (2019-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Offering (2019-2030)

10.5.2. Market Revenue and Forecast, by Application (2019-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Offering (2019-2030)

10.5.3.2. Market Revenue and Forecast, by Application (2019-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Offering (2019-2030)

10.5.4.2. Market Revenue and Forecast, by Application (2019-2030)

Chapter 11. Company Profiles

11.1. ACI Worldwide Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Alphabet Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Apple Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. FIS

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Recent Initiatives

11.5. IDEMIA

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Ingenico

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Mastercard

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. PayPal Holdings Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Square Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Visa Inc.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Buy Full Research Report (Single User License US$ 4500) @ https://www.precedenceresearch.com/checkout/1334

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

0 Comments