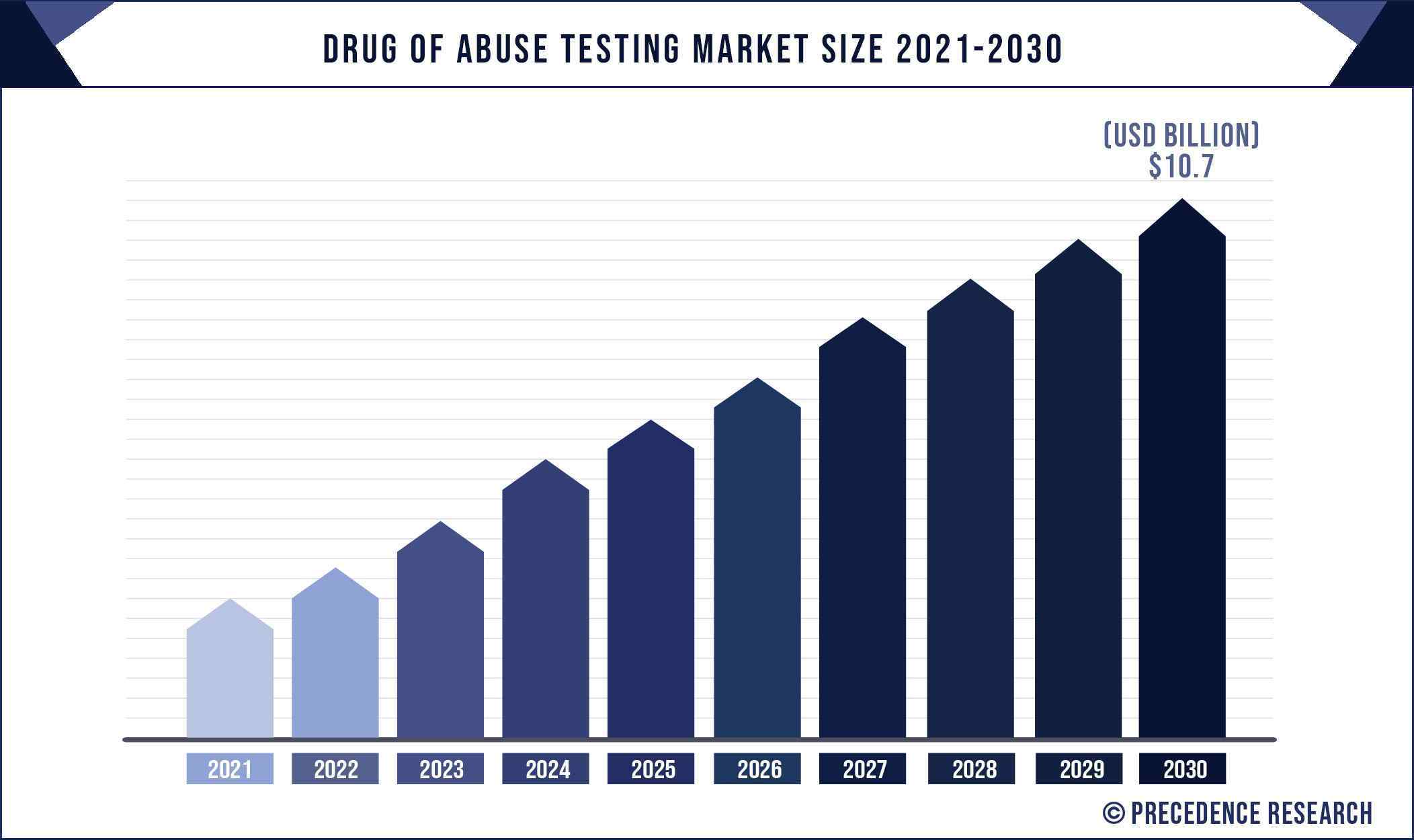

According to a new research report by Precedence Research, The Drug of Abuse Testing Market size is forecast to exceed US$ 10.7 billion by 2030 from USD 5.8 billion in 2020 and is expected to grow at the highest CAGR of 6.4% from 2021-2030. The report offers an up-to-date analysis regarding the current market scenario, latest trends, key drivers, potential challenges, profitability graph and the overall market environment.

Crucial factors accountable for market growth are:

- Growing usage of drugs like marijuana, cocaine among the youth

- Growing cases of drug use disorder

- Rising number deaths related to drug overdose

- Government initiatives to tackle drug abuse

- Technological advancements and development of cost-effective test kits

- Rising prevalence of HIV among the drug injectors

Download the Sample Pages of this Report for Better Understanding@ https://www.precedenceresearch.com/sample/1313

Report Highlights

- By drug type, the marijuana/cannabis segment led the global drug of abuse market with remarkable revenue share in 2020. This is attributed to the increased consumption and popularity of the marijuana. Moreover, in countries like India, it is easily available to the drug users due to the lack of proper administrative control on the illegal drug suppliers.

- By sample type, the urine segment led the global drug of abuse market with remarkable revenue share in 2020. This is because the urinalysis is the most accurate and feasible test. Kidney helps to remove wastes and other toxic materials from the blood through urine and hence urinalysis is much more effective.

- By end user, the workplaces segment led the global drug of abuse market with remarkable revenue share in 2020. The employers need to know about the health of their employ. A drug user frequently switches job and highly unproductive and inefficient in his work. Hence, the workplaces need to conduct drug of abuse tests.

Scope of the Drug of Abuse Market Report

| Report Coverage | Details |

| Market Size | US$ 10.7 Billion by 2030 |

| Growth Rate From 2021 to 2030 | CAGR of 6.4% |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Base Year | 2021 |

| Forecast Period | 2021 to 2030 |

| Segments Covered | Drug Type, Sample Type, End User, Region |

Regional Snapshots

North America dominated the global drug of abuse testing market. This is attributed to the highest consumption of drugs such as heroin, cocaine, cannabis, and alcohol in the region. Moreover government initiatives like the implementation Patients and Communities Act to counter the problem of drug abuse is a major factor influencing the growth of the market across the region. According to the National Survey on Drug Use and Health Report, over 500,000 teenagers in US were suffering from drug use disorders in 2018. Hence the rising use of drugs among the teenagers is a major threat to the national interests that propels the growth of the drug of abuse testing market.Further, the presence of numerous key market players in the region and their strategical developments fueled the growth of the drug of abuse market in this region.

Asia Pacific is expected to be the fastest-growing region. According to the Australian National Council – Asia Pacific Report, Cambodia has become the leading source of cannabis the globe. Major economy like China has taken an initiative to set up a huge network of drug treatment centers across the nation. Around 74.4% of the Hong Kong drug users prefers heroin and around 80% of the HIV cases in Indonesia is directly associated with the injection drug use. The Asia Pacific is becoming a major market for the illicit drug traders due to the failure of government to tackle this situation. Therefore, Asia Pacific has a huge growth potential for the drug of abuse testing market.

Some of the prominent players in the drug of abuse testing market include:

- Danaher Corporation

- LabCorp

- Abbott Laboratories

- Quest Diagnostics, Inc.

- Cordant Health Solutions

- DrugScan

- Legacy Medical Services

- Mayo Clinic Laboratories

- LGC Group

- Precision Diagnostics

Market Segmentation

By Drug Type

- Alcohol

- Cocaine

- Marijuana/Cannabis

- LSD

- Opioids

- Others

By Sample Type

- Urine

- Saliva

- Blood

- Others

By End User

- Workplaces

- Criminal Justice Systems

- Hospitals

- Research Labs

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. Market Dynamics Analysis and Trends

5.1. Market Dynamics

5.1.1. Market Drivers

5.1.2. Market Restraints

5.1.3. Market Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining power of suppliers

5.2.2. Bargaining power of buyers

5.2.3. Threat of substitute

5.2.4. Threat of new entrants

5.2.5. Degree of competition

Chapter 6. Competitive Landscape

6.1.1. Company Market Share/Positioning Analysis

6.1.2. Key Strategies Adopted by Players

6.1.3. Vendor Landscape

6.1.3.1. List of Suppliers

6.1.3.2. List of Buyers

Chapter 7. Global Drug of Abuse Testing Market, By Drug

7.1. Drug of Abuse Testing Market, by Drug Type, 2021-2030

7.1.1. Alcohol

7.1.1.1. Market Revenue and Forecast (2019-2030)

7.1.2. Cocaine

7.1.2.1. Market Revenue and Forecast (2019-2030)

7.1.3. Marijuana/Cannabis

7.1.3.1. Market Revenue and Forecast (2019-2030)

7.1.4. LSD

7.1.4.1. Market Revenue and Forecast (2019-2030)

7.1.5. Opioids

7.1.5.1. Market Revenue and Forecast (2019-2030)

7.1.6. Others

7.1.6.1. Market Revenue and Forecast (2019-2030)

Chapter 8. Global Drug of Abuse Testing Market, By End User

8.1. Drug of Abuse Testing Market, by End User, 2021-2030

8.1.1. Workplaces

8.1.1.1. Market Revenue and Forecast (2019-2030)

8.1.2. Criminal Justice Systems

8.1.2.1. Market Revenue and Forecast (2019-2030)

8.1.3. Hospitals

8.1.3.1. Market Revenue and Forecast (2019-2030)

8.1.4. Research Labs

8.1.4.1. Market Revenue and Forecast (2019-2030)

Chapter 9. Global Drug of Abuse Testing Market, By Sample

9.1. Drug of Abuse Testing Market, by Sample, 2021-2030

9.1.1. Urine

9.1.1.1. Market Revenue and Forecast (2019-2030)

9.1.2. Saliva

9.1.2.1. Market Revenue and Forecast (2019-2030)

9.1.3. Blood

9.1.3.1. Market Revenue and Forecast (2019-2030)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2019-2030)

Chapter 10. Global Drug of Abuse Testing Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Drug (2019-2030)

10.1.2. Market Revenue and Forecast, by End User (2019-2030)

10.1.3. Market Revenue and Forecast, by Sample (2019-2030)

10.1.4. U.S.

10.1.4.1. Market Revenue and Forecast, by Drug (2019-2030)

10.1.4.2. Market Revenue and Forecast, by End User (2019-2030)

10.1.4.3. Market Revenue and Forecast, by Sample (2019-2030)

10.1.5. Rest of North America

10.1.5.1. Market Revenue and Forecast, by Drug (2019-2030)

10.1.5.2. Market Revenue and Forecast, by End User (2019-2030)

10.1.5.3. Market Revenue and Forecast, by Sample (2019-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Drug (2019-2030)

10.2.2. Market Revenue and Forecast, by End User (2019-2030)

10.2.3. Market Revenue and Forecast, by Sample (2019-2030)

10.2.4. UK

10.2.4.1. Market Revenue and Forecast, by Drug (2019-2030)

10.2.4.2. Market Revenue and Forecast, by End User (2019-2030)

10.2.4.3. Market Revenue and Forecast, by Sample (2019-2030)

10.2.5. Germany

10.2.5.1. Market Revenue and Forecast, by Drug (2019-2030)

10.2.5.2. Market Revenue and Forecast, by End User (2019-2030)

10.2.5.3. Market Revenue and Forecast, by Sample (2019-2030)

10.2.6. France

10.2.6.1. Market Revenue and Forecast, by Drug (2019-2030)

10.2.6.2. Market Revenue and Forecast, by End User (2019-2030)

10.2.6.3. Market Revenue and Forecast, by Sample (2019-2030)

10.2.7. Rest of Europe

10.2.7.1. Market Revenue and Forecast, by Drug (2019-2030)

10.2.7.2. Market Revenue and Forecast, by End User (2019-2030)

10.2.7.3. Market Revenue and Forecast, by Sample (2019-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Drug (2019-2030)

10.3.2. Market Revenue and Forecast, by End User (2019-2030)

10.3.3. Market Revenue and Forecast, by Sample (2019-2030)

10.3.4. India

10.3.4.1. Market Revenue and Forecast, by Drug (2019-2030)

10.3.4.2. Market Revenue and Forecast, by End User (2019-2030)

10.3.4.3. Market Revenue and Forecast, by Sample (2019-2030)

10.3.5. China

10.3.5.1. Market Revenue and Forecast, by Drug (2019-2030)

10.3.5.2. Market Revenue and Forecast, by End User (2019-2030)

10.3.5.3. Market Revenue and Forecast, by Sample (2019-2030)

10.3.6. Japan

10.3.6.1. Market Revenue and Forecast, by Drug (2019-2030)

10.3.6.2. Market Revenue and Forecast, by End User (2019-2030)

10.3.6.3. Market Revenue and Forecast, by Sample (2019-2030)

10.3.7. Rest of APAC

10.3.7.1. Market Revenue and Forecast, by Drug (2019-2030)

10.3.7.2. Market Revenue and Forecast, by End User (2019-2030)

10.3.7.3. Market Revenue and Forecast, by Sample (2019-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Drug (2019-2030)

10.4.2. Market Revenue and Forecast, by End User (2019-2030)

10.4.3. Market Revenue and Forecast, by Sample (2019-2030)

10.4.4. GCC

10.4.4.1. Market Revenue and Forecast, by Drug (2019-2030)

10.4.4.2. Market Revenue and Forecast, by End User (2019-2030)

10.4.4.3. Market Revenue and Forecast, by Sample (2019-2030)

10.4.5. North Africa

10.4.5.1. Market Revenue and Forecast, by Drug (2019-2030)

10.4.5.2. Market Revenue and Forecast, by End User (2019-2030)

10.4.5.3. Market Revenue and Forecast, by Sample (2019-2030)

10.4.6. South Africa

10.4.6.1. Market Revenue and Forecast, by Drug (2019-2030)

10.4.6.2. Market Revenue and Forecast, by End User (2019-2030)

10.4.6.3. Market Revenue and Forecast, by Sample (2019-2030)

10.4.7. Rest of MEA

10.4.7.1. Market Revenue and Forecast, by Drug (2019-2030)

10.4.7.2. Market Revenue and Forecast, by End User (2019-2030)

10.4.7.3. Market Revenue and Forecast, by Sample (2019-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Drug (2019-2030)

10.5.2. Market Revenue and Forecast, by End User (2019-2030)

10.5.3. Market Revenue and Forecast, by Sample (2019-2030)

10.5.4. Brazil

10.5.4.1. Market Revenue and Forecast, by Drug (2019-2030)

10.5.4.2. Market Revenue and Forecast, by End User (2019-2030)

10.5.4.3. Market Revenue and Forecast, by Sample (2019-2030)

10.5.5. Rest of LATAM

10.5.5.1. Market Revenue and Forecast, by Drug (2019-2030)

10.5.5.2. Market Revenue and Forecast, by End User (2019-2030)

10.5.5.3. Market Revenue and Forecast, by Sample (2019-2030)

Chapter 11. Company Profiles

11.1. Danaher Corporation

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. LabCorp

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Abbott Laboratories

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Quest Diagnostics, Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Recent Initiatives

11.5. Cordant Health Solutions

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. DrugScan

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Legacy Medical Services

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Mayo Clinic Laboratories

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. LGC Group

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Precision Diagnostics

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Buy this Premium Research Report@ https://www.precedenceresearch.com/checkout/1313

About Us

Precedence Research is a worldwide market research and consulting organization. We give unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace &defense, among different ventures present globally.

Contact Us:

Precedence Research

Apt 1408 1785 Riverside Drive Ottawa, ON, K1G 3T7, Canada

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

0 Comments