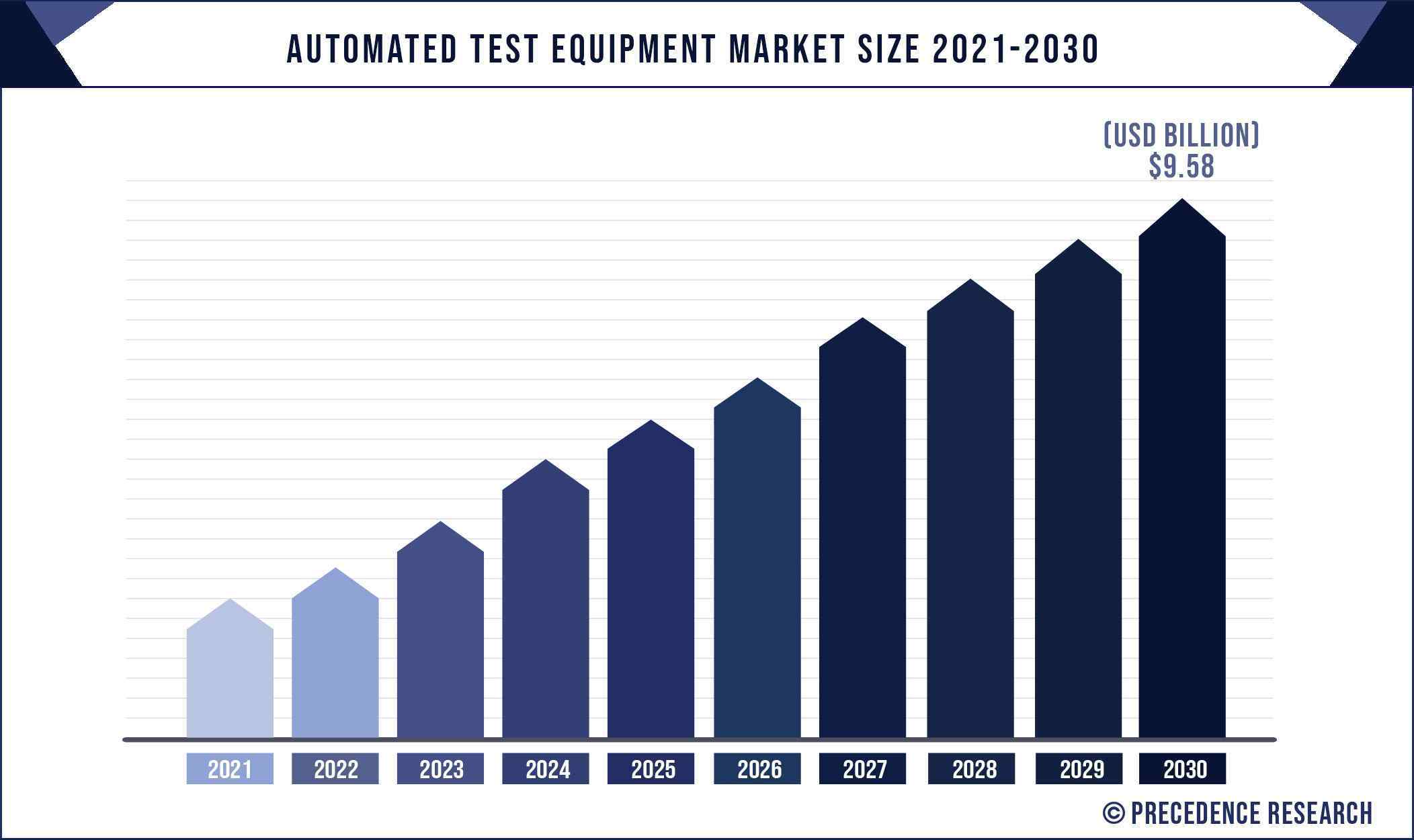

According to a new research report by Precedence Research, The Automated Test Equipment Market size is forecast to exceed US$ 9.58 billion by 2030 from USD 7.1 billion in 2021 and is expected to grow at the highest CAGR of 3.5% from 2021-2030. The report offers an up-to-date analysis regarding the current market scenario, latest trends, key drivers, potential challenges, profitability graph and the overall market environment.

Download the Sample Pages of this Report for Better Understanding@ https://www.precedenceresearch.com/sample/1305

Crucial factors accountable for market growth are:

- The rapid growth of the automotive and the semiconductor industry.

- Increasing demand for the consumer electronics products.

- The rise in demand for complex electronic devices that requires effective testing.

- The rising telecom industry positively impacts the market growth.

- The favorable Government regulations, that promotes the development of semiconductor industry.

- The rise in demand for high quality electronics equipment’s in the defense and aerospace sector.

Scope of the Automated Test Equipment Market Report

| Report Coverage | Details |

| Market Size in 2021 | US$ 7.1 billion |

| Growth Rate from 2021 to 2030 | CAGR of 3.5% |

| Base Year | 2021 |

| Forecast Period | 2021 to 2030 |

| Largest Market | APAC |

| Fastest Growing Market | North America |

| Segments Covered | Product, End User, Region |

Regional Snapshots

North America is also expected to witness a remarkable growth in the upcoming years owing to the increase in adoption of automated test equipment in the aerospace and defense sector. Asia Pacific region is estimated to dominate the market with the contribution of more than 76% of revenue share in 2021 owing to the presence of major market players in the region. China and Taiwan in this region will dominate the market share.

Report Highlights

- Asia Pacific region is expected to grow at highest CAGR contributing more than 76% of revenue share in 2021 owing to the presence of major market players in the region.

- The non-memory ATE segment holds significant market share in the automated test equipment market contributing more than 66.5% of the revenue share.

- The rapid growth of the semiconductor and the automotive sector fosters the market growth of the automated test equipment market.

- By Geography, North America is expected to hold a significant share in the Automated Test Equipment Market owing to the increase in adoption of automated test equipment’s in the aerospace and defense sector.

Market Dynamics

Driver - The increase in demand for the high quality electronics equipment in diverse industry verticals such as IT and telecommunications, defense, consumer electronics, automotive, healthcare and others is expected to drive the market growth. Also, with the favorable Government policies for the development of semiconductor fabrication plants that will boost the economy is an attribute that is anticipated to fuel the growth of the automated test equipment market. For instances, On 27th April 2021, Marvin Test Solutions, Inc. a provider of innovative test solutions for military, aerospace, and manufacturing organizations announced that, its product TS-900e-5G production test system for 5G mm Wave semiconductor devices is now in use by multiple leading semiconductor manufacturers.

Restraint - The major restraining factor that will negatively impact the growth of the Automated Test Equipment Market includes the high cost involved in the development of the automated test equipment and the presence of high competition among the major market players.

Opportunity - The Government across the world is investing heavily for the development of semiconductor industry as this will help in the significant growth of the economy. This development of semiconductor industry will find huge opportunities for the growth of the automated test equipment market.

Challenges - For conducting the research and developmental activities in the field of automated test equipment’s high expenditure is required ad this attribute is estimated to pose a major challenge in the growth of the automated test equipment market.

Recent Developments

- On 30th September, 2021 Advantest Corporation a Leading semiconductor test equipment supplier has announced a high frequency resolution option for its TAS7400TS terahertz optical sampling analysis system. It comprises of features such as excellent cost performance and ease of operation, a groundbreaking measurement method for high-frequency characteristic evaluation of radio wave absorbers and base materials, which are indispensable for Beyond 5G / 6G next-generation communications technology and for the millimeter-wave radar technology used in ADAS.

- On 12th January 2021, Teradyne Inc. a leading supplier of automated test solutions announced that the company’s UltraFLEX test platform has enabled AI chip company Syntiant Corp. to successfully ship millions of its microwatt-power, deep learning Neural Decision Processors™ to customers worldwide.

- On 24th August 2021, Astronics Corporation a leading provider of advanced technologies for global aerospace, defense, and other mission critical industries, announced a cooperative agreement with Aerotec Concept of Toulouse, France. This cooperative agreement will provide Astronics the medium to expand its comprehensive design, development, analysis, substantiation, certification, kitting and manufacturing capabilities further into the aerospace market in Europe.

Key Companies Profiled

The global automated test equipment market is characterized by the presence of various small and big players. The major market player is Aemulus Holdings Bhd (“Aemulus”); Chroma ATE Inc.; Aeroflex Inc. (a subsidiary of Cobham plc); Astronics Corporation; Advantest Corporation; LTX-Credence Corporation (Xcerra Corporation); Teradyne Inc.; Star Technologies Inc.; Tesec Corporation; Roos Instruments, Inc.; Marvin Test Solutions Inc.; Danaher Corporation.

Segments Covered in the Report

By Product

- Non-Memory ATE

- Memory ATE

- Discrete ATE

By End User

- Automotive

- Consumer

- Aerospace & Defence

- IT & Telecommunications

- Others

By Geography

- North America

- U.S.

- Canada

- Mexico

- Europe

- U.K.

- Germany

- France

- Russia

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Latin America

- Middle East

- Africa

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. Market Dynamics Analysis and Trends

5.1. Market Dynamics

5.1.1. Market Drivers

5.1.2. Market Restraints

5.1.3. Market Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining power of suppliers

5.2.2. Bargaining power of buyers

5.2.3. Threat of substitute

5.2.4. Threat of new entrants

5.2.5. Degree of competition

Chapter 6. Competitive Landscape

6.1.1. Company Market Share/Positioning Analysis

6.1.2. Key Strategies Adopted by Players

6.1.3. Vendor Landscape

6.1.3.1. List of Suppliers

6.1.3.2. List of Buyers

Chapter 7. Global Automated Test Equipment Market, By Product

7.1. Automated Test Equipment Market, by Product Type, 2021-2030

7.1.1. Non-Memory ATE

7.1.1.1. Market Revenue and Forecast (2019-2030)

7.1.2. Memory ATE

7.1.2.1. Market Revenue and Forecast (2019-2030)

7.1.3. Discrete ATE

7.1.3.1. Market Revenue and Forecast (2019-2030)

Chapter 8. Global Automated Test Equipment Market, By End User

8.1. Automated Test Equipment Market, by End User, 2021-2030

8.1.1. Automotive

8.1.1.1. Market Revenue and Forecast (2019-2030)

8.1.2. Consumer

8.1.2.1. Market Revenue and Forecast (2019-2030)

8.1.3. Aerospace & Defense

8.1.3.1. Market Revenue and Forecast (2019-2030)

8.1.4. IT & Telecommunications

8.1.4.1. Market Revenue and Forecast (2019-2030)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2019-2030)

Chapter 9. Global Automated Test Equipment Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Product (2019-2030)

9.1.2. Market Revenue and Forecast, by End User (2019-2030)

9.1.3. U.S.

9.1.3.1. Market Revenue and Forecast, by Product (2019-2030)

9.1.3.2. Market Revenue and Forecast, by End User (2019-2030)

9.1.4. Rest of North America

9.1.4.1. Market Revenue and Forecast, by Product (2019-2030)

9.1.4.2. Market Revenue and Forecast, by End User (2019-2030)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Product (2019-2030)

9.2.2. Market Revenue and Forecast, by End User (2019-2030)

9.2.3. UK

9.2.3.1. Market Revenue and Forecast, by Product (2019-2030)

9.2.3.2. Market Revenue and Forecast, by End User (2019-2030)

9.2.4. Germany

9.2.4.1. Market Revenue and Forecast, by Product (2019-2030)

9.2.4.2. Market Revenue and Forecast, by End User (2019-2030)

9.2.5. France

9.2.5.1. Market Revenue and Forecast, by Product (2019-2030)

9.2.5.2. Market Revenue and Forecast, by End User (2019-2030)

9.2.6. Rest of Europe

9.2.6.1. Market Revenue and Forecast, by Product (2019-2030)

9.2.6.2. Market Revenue and Forecast, by End User (2019-2030)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Product (2019-2030)

9.3.2. Market Revenue and Forecast, by End User (2019-2030)

9.3.3. India

9.3.3.1. Market Revenue and Forecast, by Product (2019-2030)

9.3.3.2. Market Revenue and Forecast, by End User (2019-2030)

9.3.4. China

9.3.4.1. Market Revenue and Forecast, by Product (2019-2030)

9.3.4.2. Market Revenue and Forecast, by End User (2019-2030)

9.3.5. Japan

9.3.5.1. Market Revenue and Forecast, by Product (2019-2030)

9.3.5.2. Market Revenue and Forecast, by End User (2019-2030)

9.3.6. Rest of APAC

9.3.6.1. Market Revenue and Forecast, by Product (2019-2030)

9.3.6.2. Market Revenue and Forecast, by End User (2019-2030)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Product (2019-2030)

9.4.2. Market Revenue and Forecast, by End User (2019-2030)

9.4.3. GCC

9.4.3.1. Market Revenue and Forecast, by Product (2019-2030)

9.4.3.2. Market Revenue and Forecast, by End User (2019-2030)

9.4.4. North Africa

9.4.4.1. Market Revenue and Forecast, by Product (2019-2030)

9.4.4.2. Market Revenue and Forecast, by End User (2019-2030)

9.4.5. South Africa

9.4.5.1. Market Revenue and Forecast, by Product (2019-2030)

9.4.5.2. Market Revenue and Forecast, by End User (2019-2030)

9.4.6. Rest of MEA

9.4.6.1. Market Revenue and Forecast, by Product (2019-2030)

9.4.6.2. Market Revenue and Forecast, by End User (2019-2030)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Product (2019-2030)

9.5.2. Market Revenue and Forecast, by End User (2019-2030)

9.5.3. Brazil

9.5.3.1. Market Revenue and Forecast, by Product (2019-2030)

9.5.3.2. Market Revenue and Forecast, by End User (2019-2030)

9.5.4. Rest of LATAM

9.5.4.1. Market Revenue and Forecast, by Product (2019-2030)

9.5.4.2. Market Revenue and Forecast, by End User (2019-2030)

Chapter 10. Company Profiles

10.1. Aemulus Holdings Bhd (“Aemulus”)

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. Chroma ATE Inc.

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Aeroflex Inc. (a subsidiary of Cobham plc)

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. Astronics Corporation

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. Advantest Corporation

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. LTX-Credence Corporation (Xcerra Corporation)

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. Teradyne Inc.

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. Star Technologies Inc.

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3. Financial Performance

10.8.4. Recent Initiatives

10.9. Tesec Corporation

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

10.10. Roos Instruments, Inc.

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Buy this Premium Research Report@ https://www.precedenceresearch.com/checkout/1305

About Us

Precedence Research is a worldwide market research and consulting organization. We give unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace &defense, among different ventures present globally.

Contact Us:

Precedence Research

Apt 1408 1785 Riverside Drive Ottawa, ON, K1G 3T7, Canada

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

0 Comments